Aldeman: Teachers Have the Nation’s Highest Retirement Costs. But They’ll Never See the Benefits

As teachers have staged walkouts and strikes in West Virginia, Oklahoma, Kentucky, and perhaps Arizona, most of the news coverage has focused on big-picture questions about state education budgets or average teacher salaries. But this misses a large trend going on in the background — teachers, like other workers in the American economy, are forgoing base salary increases in favor of in-kind benefits.

In 2016, I wrote a paper called “The Pension Pac-Man,” attempting to raise awareness of these issues. Using national data from the Bureau of Labor Statistics and other sources, I found that teacher salaries hadn’t increased, in inflation-adjusted terms, since the early 1990s. But while base teacher salaries have not risen, total teacher compensation has, driven by large increases in health care and retirement costs. That is, there’s a growing disconnect between what teachers are paid and what their employers pay for them.

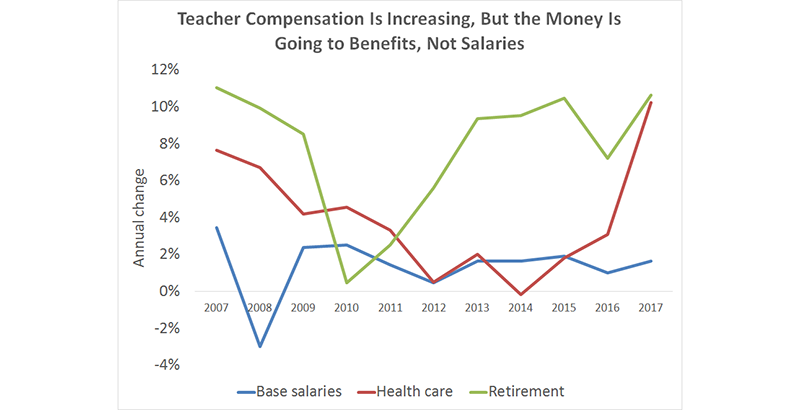

This trend has accelerated rapidly over the past 10 years. Across the country, benefit costs are increasing much faster than salaries. At some level, this trend is playing out across the broader American economy as the baby boom generation begins to retire and as health care costs have soared. Over the past decade, civilian employers have paid average annual wage increases of 2.3 percent, their health care contributions have risen by 3.2 percent, and retirement costs have increased by 4.9 percent a year.

Schools have increased their share going toward benefits even faster than other employers have. To see what this looks like visually, consider the following graph. It uses the bureau’s Employer Costs for Employee Compensation data on public school teachers. On average, over the past 10 years, teacher salaries have increased 1.4 percent a year, compared with 4 percent for health insurance and 7.8 percent for retirement.

As a percentage of each worker’s compensation, teacher health care costs are on the high end, but they are not an extreme outlier. In contrast, teachers have by far the highest retirement costs, even compared with other public-sector employees. While the average civilian employee receives $1.92 per hour worked for retirement benefits, teachers receive $7.38 per hour in retirement compensation. As a percentage of the total compensation package, teacher retirement benefits eat up more than twice as much as other workers’ (11.6 percent versus 5.4 percent).

To be clear, the data reflects the employer’s cost to employ someone, not what the employee actually receives. Unfortunately for teachers, the rising costs of their retirement systems do not reflect improved benefits; they’re primarily a function of debt. Within pension systems, there are two types of contributions: the cost needed to provide benefits (called the normal cost) and the cost of paying down debt (amortization costs). The normal cost is the amount of money a pension plan projects it needs to contribute now to pay benefits in future years. The amortization cost is the amount required to pay down accrued debt.

If pension costs were rising because normal costs were rising, that would reflect an improvement in teacher benefits. But that’s not what’s happening: Today, amortization costs, not normal costs, make up the biggest proportion of employer retirement costs. For every $100 paid in salary, states and school districts are paying $12 toward pension debts and only $5 in benefits for current teachers.

This doesn’t even get into the distributional issues in traditional teacher pension plans. All the numbers I’ve talked about so far reflect averages across the entire teaching profession, but pension plan benefits are so backloaded that most short- and medium-term teachers get far less. The promise of a pension benefit pays off for only the 15 to 20 percent of teachers who remain as educators in one state for their entire career.

In other words, teachers are getting squeezed in multiple ways. On one hand, state and local budgets are not providing as much to education as they did 10 years ago. Those cuts are visible and easily quantifiable. It’s much harder for teachers to see that their take-home pay is being diminished due to rising benefit costs.

But these trends can’t continue forever. After all, teachers can’t buy food, afford child care, or pay their mortgages with the promise of future benefits — especially ones that never come.

Chad Aldeman is a principal at Bellwether Education Partners and the editor of TeacherPensions.org.

Disclosure: Chad Aldeman is a principal at Bellwether Education Partners. It was co-founded by Andy Rotherham, who sits on The 74’s board of directors and serves as one of the site’s senior editors.

Get stories like these delivered straight to your inbox. Sign up for The 74 Newsletter

;)