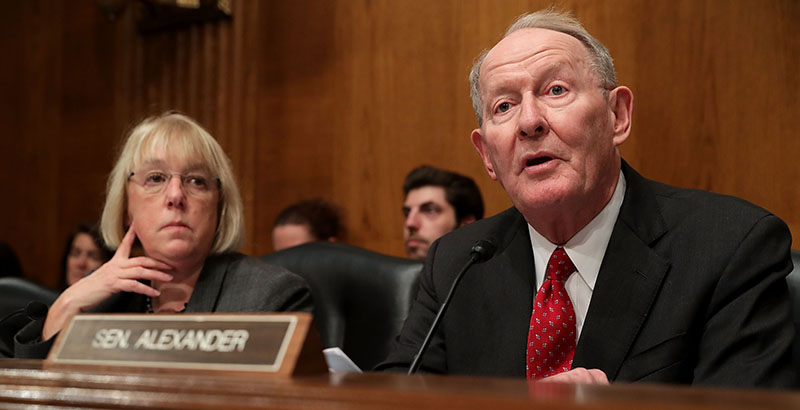

The School Choice Now Act: Senators Alexander and Scott Introduce Bill to Fund Emergency Scholarships Families Can Use Toward School Tuition or Homeschooling During the Pandemic

Two members of the Senate education committee, chairman Lamar Alexander of Tennessee and Sen. Tim Scott of South Carolina, introduced new legislation Wednesday that would provide federal aid to assist families in paying for private school or homeschooling during the pandemic.

The School Choice Now Act would use 10 percent of emergency education aid to offer one-time emergency funding for scholarship organizations approved by the state. These scholarships could then be used by families to go toward private school tuition or homeschooling expenses.

In a Wednesday statement, Alexander said: “Giving children more opportunity to choose their school is a real answer to inequality in America.

“All parents, regardless of income or circumstance, should be able to decide which school best meets their child’s needs, whether that school is public or private … the School Choice Now Act provides scholarships to students to have the opportunity to return to the private school they attended before the pandemic — and gives other students a new opportunity to attend private school.

“Children in all K-12 schools, public and private, have been affected by COVID-19 … Many schools are choosing not to reopen and many schools are failing to provide high-quality distance learning. The students who will suffer from this experience the most are the children from lower income families. This bill will give families more options for their children’s education at a time that school is more important than ever.”

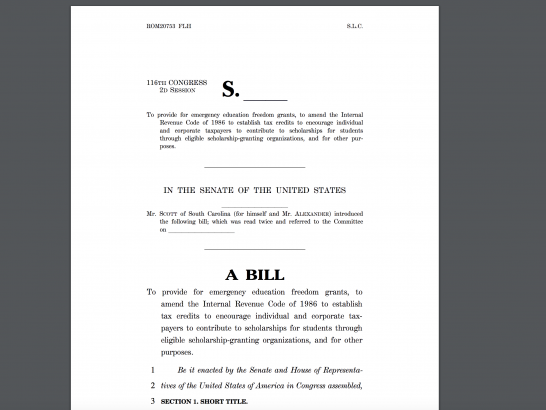

See the full text of the legislation right here, or by clicking below. One notable excerpt from the bill, about how — and when — states must used any approved funds:

“By not later than 60 days after receiving an allotment under subsection, a State without a tax credit scholarship program shall use not less than 50 percent of the allotment to award subgrants to eligible scholarship-granting organizations in the State.

An eligible scholarship-granting organization that receives a subgrant under this subsection:

- “May reserve not more than 5 percent of the subgrant funds for public outreach, student and family support activities, and administrative expenses related to the subgrant.

- “Shall use not less than 95 percent of the subgrant funds to provide qualifying scholarships for qualified expenses only to individual elementary school and secondary school students who reside in the State in which the eligible scholarship-granting organization is recognized.

“A State shall return to the Secretary any amounts of the allotment received under this section that the State does not award as subgrants under subsection (d) by March 30, 2021, and the Secretary shall reallocate such funds to the remaining eligible States.”

Read the full bill by clicking below; also see Kevin Mahnken’s recent coverage of President Trump’s support for federal tax-credit scholarships.

Get stories like these delivered straight to your inbox. Sign up for The 74 Newsletter

;)