Three Things to Know About National Education Tax Credit Survey

New YouGov poll found education tax credit support from 80 percent of K-12 parents — pointing to a growing interest in school choice options.

Get stories like this delivered straight to your inbox. Sign up for The 74 Newsletter

As parents increasingly look for new learning options for their children, the appeal of education tax credit programs have grown, a new YouGov poll found.

The poll released by Yes. Every Kid., a school choice advocacy group, surveyed 1,000 adults, including about 200 K-12 parents, exploring their views on education tax credits — state programs giving families the ability to offset the cost of private school tuition by refunding portions of their taxes to them.

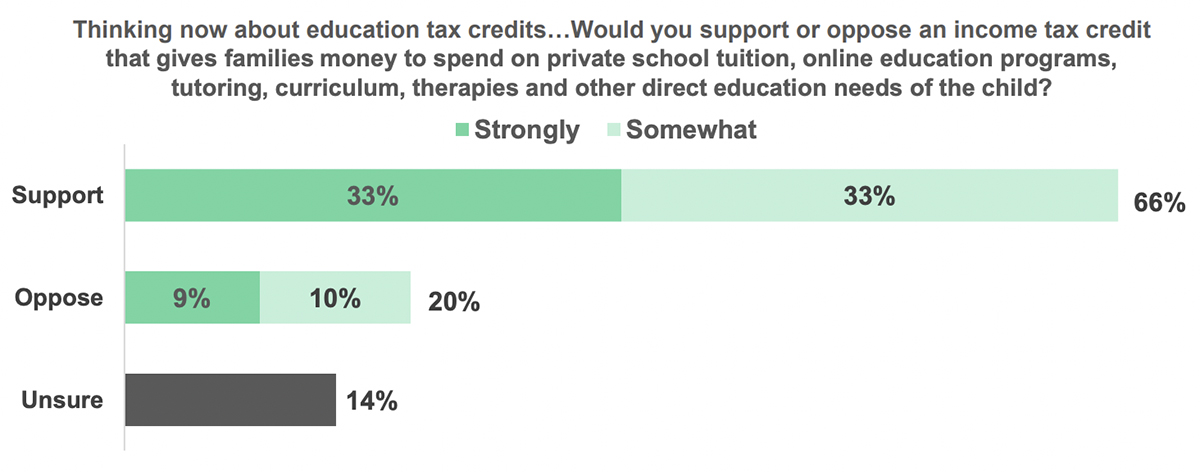

Nearly 70 percent of adults surveyed “strongly” or “somewhat” supported education tax credits — with even higher support from 80 percent of K-12 parents.

“Parents see this as an opportunity to have a little bit more authority over their kids’ education…and coming out of the pandemic, obviously, that support has skyrocketed,” said Matthew Frendewey, vice president of strategy at Yes. Every Kid.

But education tax credits are controversial, with supporters, often Republicans, backing the program’s boon for family empowerment; and opponents, often Democrats, arguing the program undermines public education by rerouting state funding to private schools.

Similar programs include education savings accounts that continue to face partisan divides for how parents have used the funds — raising eyebrows on purchases such as kayaks and trampolines, cowboy roping lessons and tickets to entertainment venues like SeaWorld.

Awareness of education tax credits was spurred after Oklahoma passed the largest and most expansive program since the first program began in 1987 — reserving families private school funding that caps at $150 million in 2024, and increases to $200 million in 2025 and $250 million in 2026.

Other states with education tax credit programs include Alabama, Illinois, Iowa, Minnesota, Ohio and South Carolina.

Lily Landry, a senior legislative analyst at Yes. Every Kid., said education tax credit programs give families the flexibility to choose the best learning option without government oversight.

“There’s not as much checks and balances for families to spend their money,” said Landry. “We’re putting trust in families that know what is best for their child.”

Here are three things to know about education tax credits:

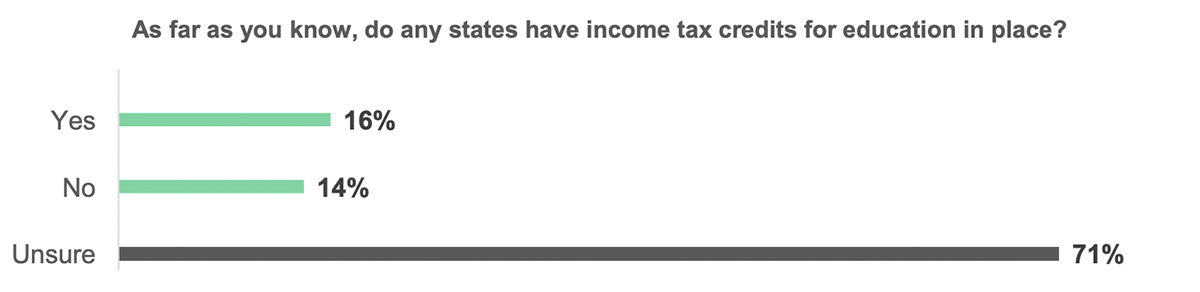

1. While most adults support education tax credits, a majority are unaware if any states offer them.

Despite strong support for education tax credit programs, more than 70 percent of adults are unaware if any states offer them.

Landry said the general lack of awareness of school choice programs lends itself to the uncertainty most adults surveyed had.

“A big problem that we see is that when legislation is written they don’t outline how whoever is administering or leading the program has to communicate with parents and families about their options,” Landry said.

The more aware parents are of education tax credits the more likely they approve of the program, Frendewey said.

“When you’re dominated by the traditional neighborhood public school, a lack of awareness exists around what options are out there,” Frendewey said. “But when you get the awareness, there’s been tremendous support.”

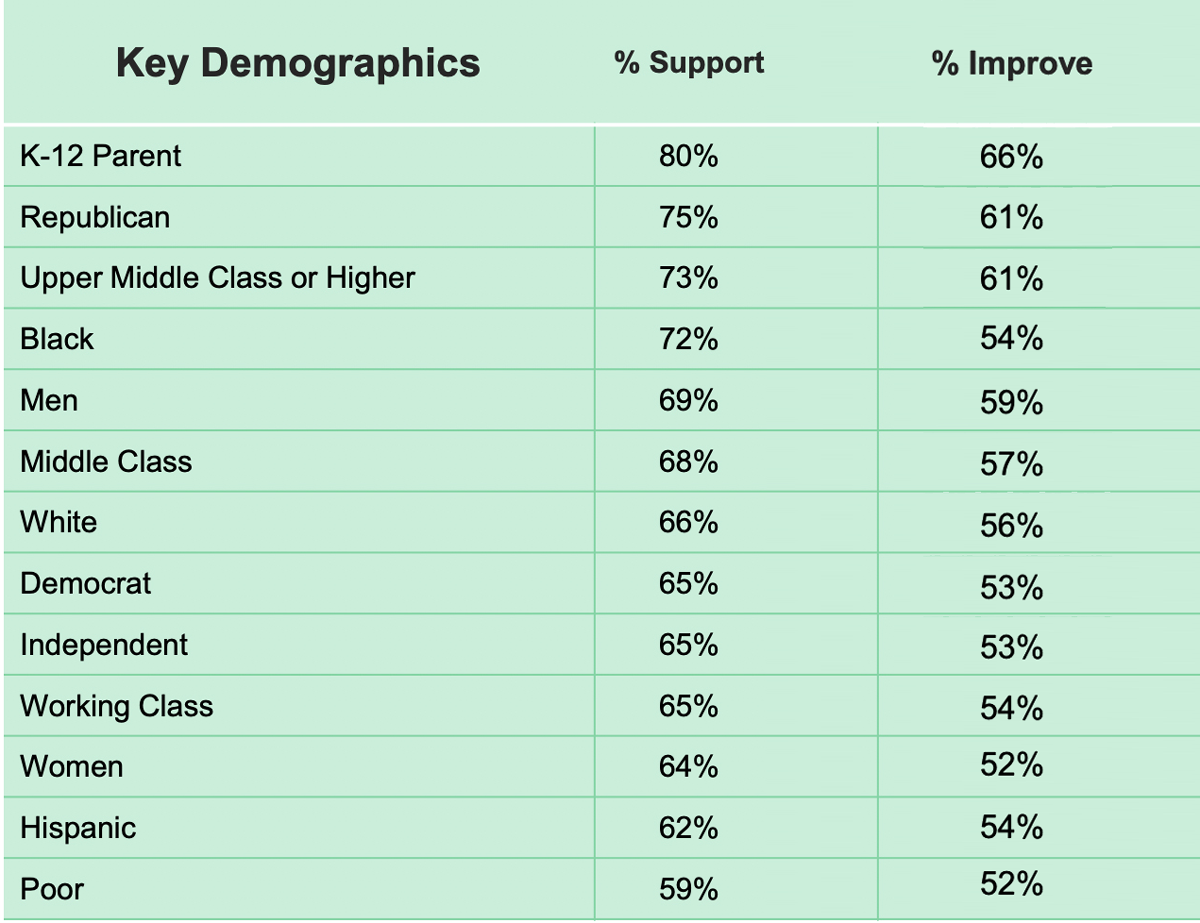

2. Poor adults have the lowest support for education tax credits and the lowest belief that they would improve the overall education system.

Less than 60 percent of poor adults support education tax credits and about 50 percent believe they will improve the education system.

Frendewey pointed to the lack of “exposure” to how education tax credits work as an explanation for the survey findings.

“Most families who are middle to lower income probably don’t feel that structure benefits them,” Frendewey said. “Just the name of it alone probably makes a lot of families feel like that’s not something they’d qualify for.”

“A tax credit requires you to pay out of pocket first and then get refunded, so that’s really difficult for middle and low income families,” Frendewey added.

The largest support comes from not only K-12 parents but also 75 percent of Republicans and 73 percent of upper middle class or higher adults.

Families from higher income households are typically more aware of school choice options, Landry added.

“The information might not be getting to some of the communities that need it or might be able to utilize it,” Landry said.

3. Parents who support education tax credits also favor education savings accounts, public school open enrollment and part-time public school access.

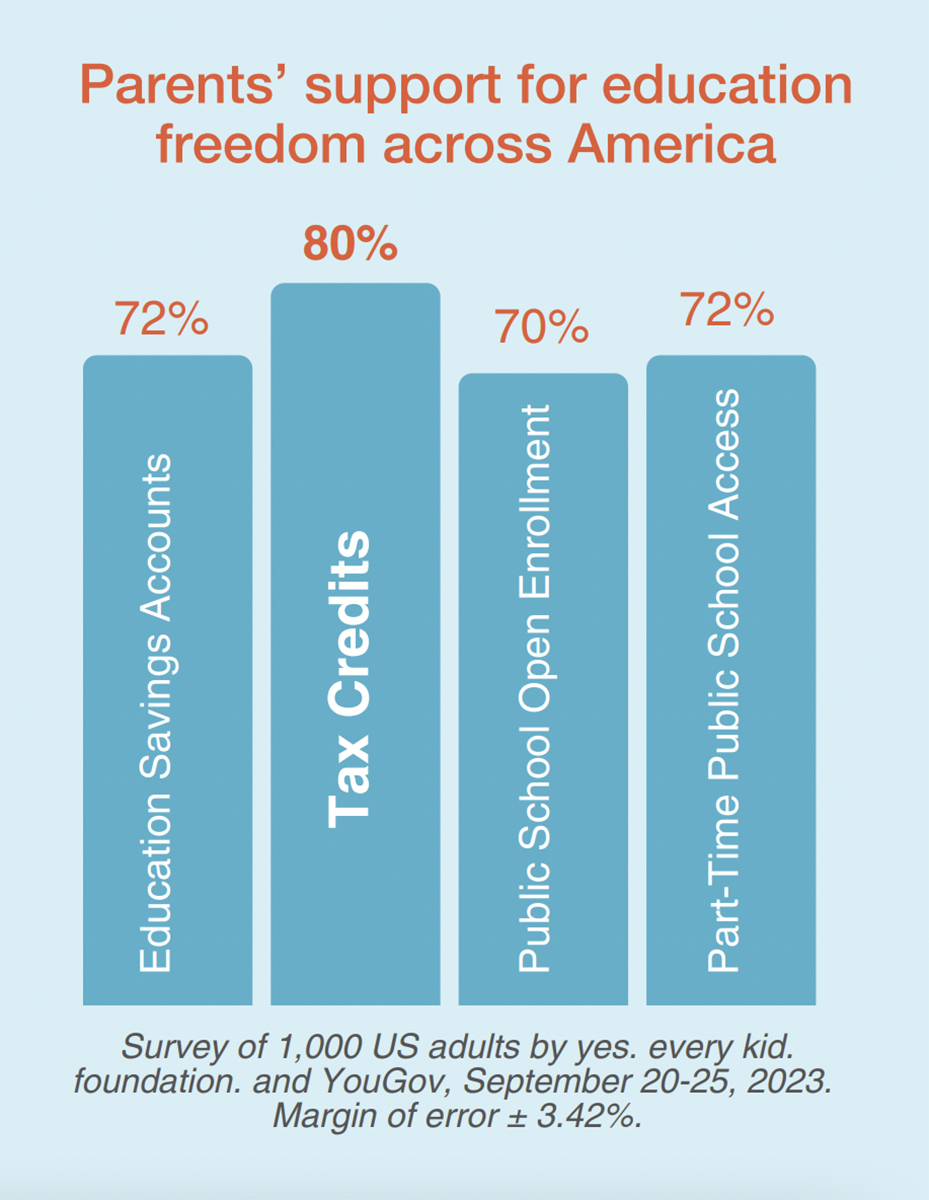

Among the 80 percent of K-12 parents in support of education tax credits, 72 percent support education savings accounts, 70 percent support public school open enrollment and 72 percent support part-time public school access.

“Even if parents don’t want to exercise choice for themselves, they see a value in creating more options for the overall ecosystem,” Frendewey said, adding this is in part due to how the pandemic empowered families to create unique ways to educate their kids.

“What it exposed to parents was that pluralism is good,” Frendewey said. “The opportunity to have a more diverse education marketplace is an overall benefit to all kids whether or not you’re going to choose your local public school, private school or homeschool co-op.”

Disclosure: Yes. Every Kid. operates as part of the wider Stand Together Trust network. Stand Together Trust provides financial support to The 74.

Get stories like these delivered straight to your inbox. Sign up for The 74 Newsletter

;)