State Voucher Programs Signal Pitfalls for Trump’s New Education Tax Credits

Toch & DiMarco: Without significant guardrails, the expensive new federal initiative is likely to deliver a scant return on investment for students.

Get stories like this delivered straight to your inbox. Sign up for The 74 Newsletter

The federal education tax credit tucked into President Donald Trump’s “One Big Beautiful Bill” would fund private and religious K-12 school scholarships for all but the nation’s wealthiest families. The initiative is a sharp break from decades of federal education policy that focused on strengthening public schools, particularly for low-income and historically underserved students.

State participation in the program is optional, but there’s no limit on the number of individuals who can contribute — via dollar-for-dollar tax credits, up to $1,700. The only limitation on the number of students who can use the scholarships is the scale of contributions flowing into the program; even families earning more than $400,000 could be eligible.

Estimates of lost tax revenue under the program vary widely. But as the Treasury Department builds out the details in the coming months, it would do well to heed the lesson of comparable state-run universal private school choice systems that have emerged in recent years: In the absence of significant guardrails, the expensive new federal initiative is likely to deliver a scant return on investment to the nation’s students.

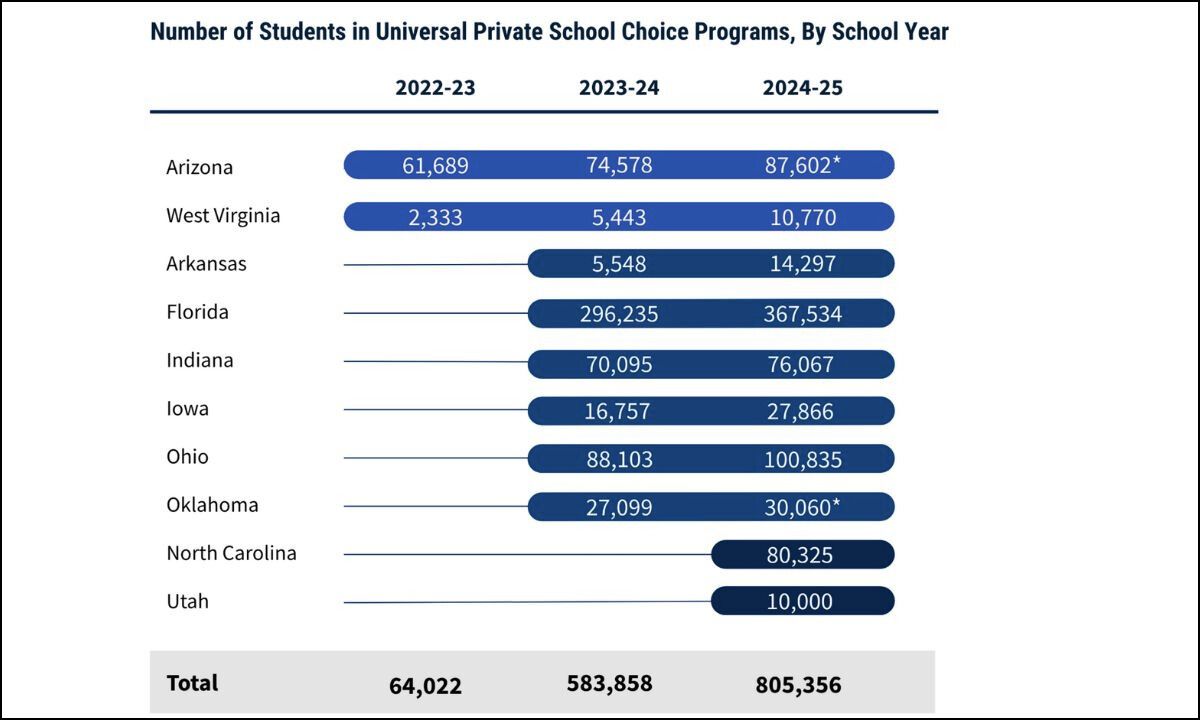

While targeted private school choice programs have been around since 1990, in the past three years Republican lawmakers in 10 states have launched programs permitting all, or nearly all, students to use public funds for private schooling, regardless of family income or the quality of the public schools they attend. Last school year, 805,000 students participated in the programs, at a cost to taxpayers of $5.75 billion.

In most states, the primary beneficiaries have been families whose children were already enrolled in private schools. They are more likely to be aware of the programs and have a clear financial incentive to apply than public school families who often face barriers (such as admissions requirements and limited availability) in the private school market.

Parents using public dollars for private schooling are also disproportionately likely to be affluent. In Oklahoma, for example, 25% of 2024-25 participants were from families earning more than $250,000 — just 5% of Oklahoma households. These programs often end up subsidizing the decisions that wealthier families were already making; absent a prioritization of low-income students, there’s little reason to expect the federal program would unfold differently.

But even with federal scholarships in hand, many families may struggle to find private school options — especially in rural areas with limited supply — or they may find a lack of open seats in the schools they prefer. Our research has found that some of the most selective or high-cost private schools opt out of state programs to avoid regulation or because scholarships don’t cover full tuition. In Florida, 1 in 4 private schools decline to participate, with most of the holdouts among the state’s most prestigious.

That’s one reason many public school students who apply and qualify for state scholarships don’t use them. In the first year of Iowa’s universal program, for example, public school enrollees accounted for 40% of the approved applicants but made up less than 13% of actual participants.

The expansion of universal choice programs, meanwhile, has outpaced state oversight in several instances. Arizona, which lets students use public funds for a wide range of education expenses, has faced a flood of reimbursement requests and in response has adopted a “pay-now, audit-later” system in which purchases under $2,000 are automatically approved — raising the risk that questionable spending would go unnoticed. Arizona families have tried to buy everything from $24,000 golf simulators to $5,000 Rolexes with tax dollars. Utah tightened its rules after families used public funds for zoo memberships and pianos that lawmakers didn’t think fit with the intended purpose of the program.

And despite billions in public spending, many independent studies done over the years have found that students who use public funds to switch from public to private schools show no academic gains, and sometimes do worse.

The new wave of universal programs is harder to assess. Beyond the fact that the programs are in their early stages, many states haven’t established metrics for success, and most don’t require participating private schools to administer state standardized tests or report academic results in some other way. In states where public funds can be spent on tutoring, materials or enrichment in addition to tuition, measuring educational value becomes even more problematic.

In Iowa, one of the few states that mandates state testing under universal choice, we found that scholarship recipients, particularly those from low-income families, outperformed their public school peers in 2023–24. But because most were already enrolled in private schools, it’s unclear whether the program actually changed student outcomes. And we found alarmingly low proficiency rates in several Ohio private schools serving voucher students. At one school, just 3 of 179 students using a voucher for at least three years scored as proficient in math in 2023-24. (On the other hand, a recent Urban Institute study found that Ohio voucher students were more likely to attend college than their public school peers, even as earlier research showed they scored lower on standardized tests.)

Neither congressional Republicans nor the Trump administration talked much about school quality, student achievement or return on public investment in the run-up to the passage of the new federal school choice program. Instead, they stressed the importance of choice for its own sake. Letting families choose is what matters most, they said.

But the experience of the nascent universal private school choice initiatives in the states suggests that without some important features — prioritizing families with the greatest need; establishing success metrics; requiring public reporting of student performance; clearly defining allowable academic expenses; and building systems to monitor and prevent fraud — the costly new federal program isn’t likely to do much to address the nation’s pressing need to give many more students a high-quality education.

Get stories like these delivered straight to your inbox. Sign up for The 74 Newsletter

;)