Setting the Record Straight: An Education Expert Resurfaces Independent Report to Explain Los Angeles Schools’ Fiscal Turmoil

The financial state of the nation’s second-largest school district in Los Angeles can be convoluted and complex. But it’s important to read up, as the conversation on how much money the district has continues to swap out facts for politics, education expert Robin Lake said.

Lake, director of the Center on Reinventing Public Education, resurfaced a 2015 independent finance report commissioned by former L.A. Unified superintendent Ramón Cortines, summarizing its findings in a tweet string. The nonpartisan report attributed L.A. Unified’s money troubles to factors including “a significant structural deficit,” California’s low (albeit disputed) rank nationally in per-pupil funding, ballooning health care and pension costs, a disproportionate number of administrators, and declining student enrollment due not only to charters — which are increasingly being blamed for traditional public schools’ plight — but also birth rate declines, dropouts and transfers out of the district.

“If people are going to be weighing in … I think there’s a responsibility to take a look at what the facts are,” said Lake, who tweeted on the report during January’s teacher strike. “People have been pretty quick to point fingers.”

Though there has been “a long string of reports” on L.A. Unified’s finances, the 2015 report is reputable because the commission that produced it was “much more” nonpartisan and is not tied to the district’s current superintendent, Charles Kerchner, professor emeritus at Claremont Graduate University, told LA School Report in an email earlier this year. Superintendent Austin Beutner is a former businessman who was frequently disparaged by United Teachers Los Angeles before and during January’s teacher strike.

The report’s findings, which Kerchner called “relatively clean,” remain relevant in 2019.

The district’s updated budget and fiscal stabilization plan, unveiled last month, highlighted L.A. Unified’s deepening reliance on new funding — especially after it approved a new teacher contract in January that adds $840 million to its bills through 2021. Although L.A. Unified ended this past school year with a record nearly $2 billion in reserves, projections show that cushion near depletion by 2021. Without new funding, the district would be at risk of a county takeover. Officials are currently banking on a parcel tax on the ballot in June, and increased state funding, to help the district stay afloat in the coming years.

“I have a lot of sympathy for paying teachers what they’re worth, and teachers have hard jobs. I don’t want to dismiss that reality,” Lake said. “But it’s a common tactic for districts to take the politically expedient route of settling a contract with numbers they can’t afford. … And ultimately, kids will pay the price for it.”

Here is Lake’s tweet string:

Some facts about the cause of LAUSD’s financial woes straight from a 2015 independent financial review. (note how many recommendations were not acted upon). Sorry, this is long, but that reflects the complexity of the root causes. @capriceyoung @MichaelPetrilli @arotherham

— Robin Lake (@RbnLake) January 15, 2019

All large urban school systems have unique issues, but they are magnified in Los Angeles because the District must deal with these issues while laboring under California’s school financial system, which still provides among the lowest per-student funding amounts in the nation.

— Robin Lake (@RbnLake) January 15, 2019

High reliance on sales and income taxes reduce the stability and predictability of revenues. The nation’s largest school district, New York City Public Schools, provides $23,690 per student for funding—nearly double the amount of revenues allotted for LAUSD’s students.

— Robin Lake (@RbnLake) January 15, 2019

Much of the volatility is related to past, present & future declining enrollment, high costs for employee benefits, sp ed services, and retiree benefits. But the vagaries of the economy and trends in state and federal requirements and funding levels are also significant factors.

— Robin Lake (@RbnLake) January 15, 2019

About 1/2 of the loss of students is due to increased enrollments in charter schools, but about 1/2 due to decline in the birth rate as well as students dropping out of school or transferring to other school districts.

— Robin Lake (@RbnLake) January 15, 2019

It must be recognized that there is no one cause for the decline in the District’s enrollment, but rather it is the culmination of various factors, some within and some outside, of the District’s control.

— Robin Lake (@RbnLake) January 15, 2019

The District must make every effort to attract and retain students and parents by offering high-quality schools, but also must not put off difficult financial decisions by making unrealistic assumptions about future enrollment.

— Robin Lake (@RbnLake) January 15, 2019

Even if LAUSD had no more new charter schools, its enrollment would continue to decline due to demographic factors, factors that are not within its

control, and that are unlikely to reverse in the coming years.— Robin Lake (@RbnLake) January 15, 2019

The District has not reduced staff commensurate with loss of enrollment

and, in fact, had experienced higher salary costs because of both salary and benefit increases and increases in staff.— Robin Lake (@RbnLake) January 15, 2019

More than 56% of District teachers have reached the maximum salary level, 10% above the average for the state. pic.twitter.com/5vfsumtEPr

— Robin Lake (@RbnLake) January 15, 2019

Currently, 75% of staff has a strong attendance. If 25% of school site staff are missing 5% or more of their work during the school year, the loss of instruction time and productivity, and the expense of finding substitute labor, is deeply troubling.

— Robin Lake (@RbnLake) January 15, 2019

Of the $9,788 in over ADA revenues received from the state, fully 27% of that payment goes to cover pension and healthcare costs, according to the CDE. Per FTE, the District’s expenditures for benefits is 9.4% higher than the statewide average.

— Robin Lake (@RbnLake) January 15, 2019

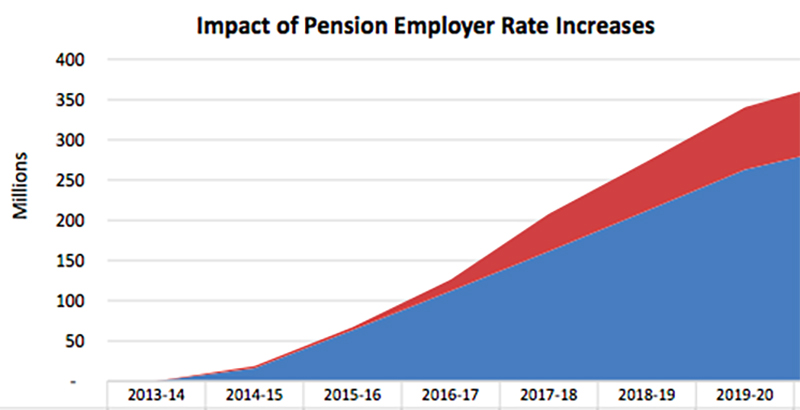

The California Public Employees’ Retirement System (CalPERS) and the California State Teachers’ Retirement System (CalSTRS) pension reforms have brought increased costs to the District. pic.twitter.com/6TN4TqV87J

— Robin Lake (@RbnLake) January 15, 2019

The District serves one of the largest populations of Special Education students in the country. Data implies there is an over identification of students in LAUSD’s Special Education program. But, only about 70% of the cost is paid by dollars specifically identified for Sp Ed.

— Robin Lake (@RbnLake) January 15, 2019

I could go on, but obviously, the reasons for LAUSD’s financial mess are complex. Anyone trying to simplify to one cause is mistaken or intentionally spinning. Here’s the report https://t.co/ACvG30N5fb

— Robin Lake (@RbnLake) January 15, 2019

Read the full 2015 Report of the Independent Financial Review Panel here.

For more about how L.A. Unified could pay for the contract, read our latest article:

And here are some of our previous articles on the district’s finances:

‘Painful truth’: 9 numbers haunting LAUSD as strike continues

Get stories like these delivered straight to your inbox. Sign up for The 74 Newsletter

;)