New England Teachers Get Rawest Retirement Deal in the Country; 0 in MA Will Ever See Investment Returns

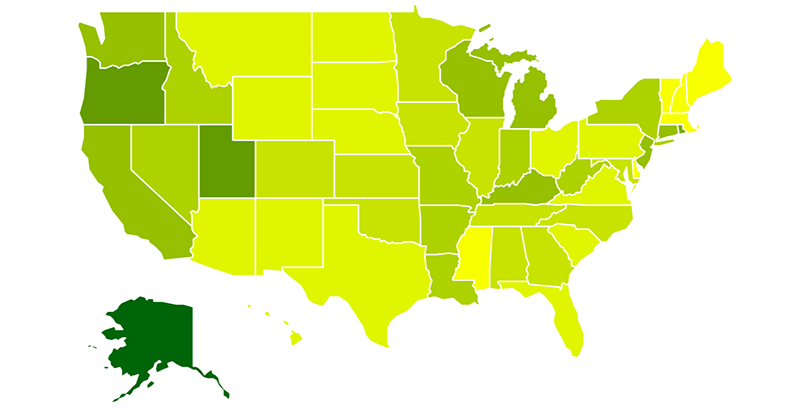

Teachers across the country are getting a raw deal on retirement compensation, often waiting years longer to vest than employees in the private sector. But they tend to have it worst in the six New England states of Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island, and Vermont.

The statewide break-even rates — the percentage of new teachers who will go on to earn pension benefits equal to or greater than their own contributions plus interest — are perhaps the most disheartening, according to a report by Bellwether Education Partners.

Across the country, just 28 percent of teachers reach this longed-for goal. In the leafy precincts of New England, it gets a lot worse. Just 4 percent of Vermont’s new teachers will ever get as much or more out of their pensions than they put in, along with 2 percent of Maine’s.

Massachusetts, the birthplace of America’s public education system and home to 72,000 teachers, has the lowest break-even rate in the country: 0 percent. Plainly stated, none of Massachusetts’s new teachers will ever attain positive benefits from their retirement contributions. Making matters worse, teachers in the state aren’t covered by Social Security.

It might seem surprising that in one of the most liberal regions in the country, where teachers unions are often at their strongest, teachers are often getting stiffed after decades of work in the classroom. But more findings from the study are clear:

-

On average, about 46 percent of teachers vest in their contract (become eligible to receive employer pension contributions beyond what they themselves put in), and those only after an average of 6.6 years. Teachers in four of the six New England states vest at lower rates than the national average, with particularly bad figures in Maine (14 percent) and Massachusetts (12 percent).

-

On average, New England teachers wait 7.5 years to vest, nearly a full year longer than the national average.

-

In all six states, the percentage of teacher retirement contributions devoted to servicing pension debt is higher than the already-high national average of 63 percent. (Vermont’s is the second-highest in the country, at 90.1 percent.)

The Bellwether report assigned grades to each state for how well its retirement system serves educators: 42 states and the District of Columbia received failing grades. No state received an A or a B. Each New England state received an F, although that’s the case for nearly every state in the country. More revealing are the study’s cumulative scores. Massachusetts, Maine, Connecticut, Vermont, and New Hampshire all rank in the bottom 13 jurisdictions in the country.

We seem to be living in a halcyon age of teacher pension research. In January, The 74’s Matt Barnum dove into a damning national study from the Fordham Institute that found that most educators have to wait a quarter-century before qualifying for full benefits. The Urban Institute has sounded off on the same topic, skewering most of the country for poor fiscal management.

As one of the Bellwether study’s co-authors told The 74 in an interview, “The majority of teachers will not benefit from the current system, and that doesn’t seem right. Right now there’s a small group of winners and a very large group of losers.”

Get stories like these delivered straight to your inbox. Sign up for The 74 Newsletter

;)