More Than a Quarter Million Fewer Students Applied for Financial Aid During Pandemic, Signaling COVID’s Effect on College Entry

Get essential education news and commentary delivered straight to your inbox. Sign up here for The 74’s daily newsletter.

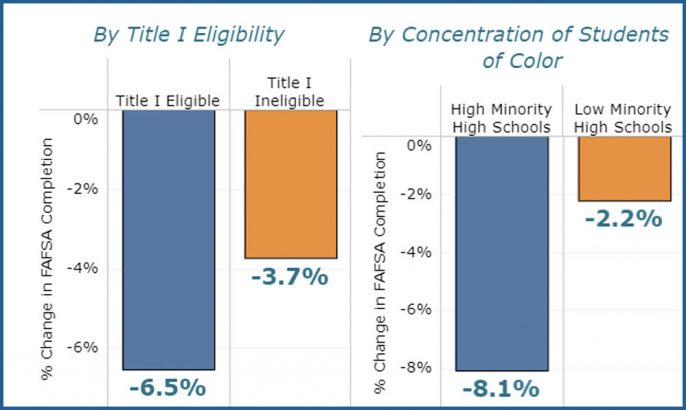

More than a quarter of a million fewer high school seniors have applied for financial aid since the beginning of the pandemic, and the slip is particularly striking in schools with high minority and low-income student populations — an early indicator that the decline in college enrollment among disadvantaged students is continuing.

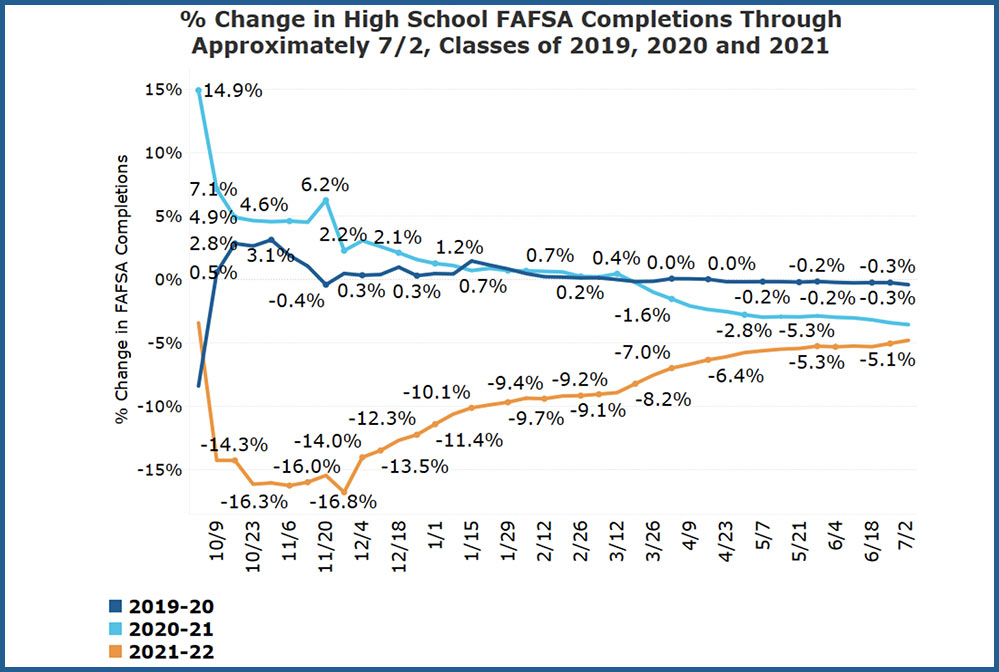

The analysis, released Monday by the National College Attainment Network, shows just over half of this year’s graduating class, 53 percent, had completed a Free Application for Federal Student Aid, or FAFSA, by July 2 — 190,000 fewer than in 2019 and the second year in row with a decline. Research shows a strong link between completing the application and enrolling in college.

“The real challenge is there are going to be some assumptions that because the fall semester is going to look more normal on college campuses, that students will just show up,” said Bill DeBaun, the nonprofit’s director of data and evaluation. “College-going is not a light switch.”

While this year’s graduates have until the end of June 2022 to file for assistance for 2021-22, the decline in applications last year was accompanied by an almost 7 percent decline in recent high school graduates — especially high among those from low-income families — immediately enrolling in college, according to the National Student Clearinghouse Research Center.

States have moved in recent years to make FAFSA completion a requirement for high school graduation, but the disruption in college advising for this year’s graduating class began the day schools closed for the pandemic. College counselors struggled to maintain contact with students remotely, but some are now stepping up efforts to get students back on track.

DeBaun noted that while the class of 2020 still had almost three-fourths of a typical senior experience — and might have filed financial forms before schools shut down — this year’s class not only had an “entirely abnormal” year but missed out on spring college advising activities at the end of their junior year.

The decline in completion rates was almost four times higher in schools where more than half of the students are Black and Hispanic. In Title I-eligible schools, rates were down 6.5 percent compared to 3.7 percent in schools with less poverty.

Some students have entered the workforce to help out their families during the pandemic, but DeBaun said it’s the combination of economic setbacks — hunger, housing mobility, lack of internet access and having to share learning space with siblings — that have derailed students’ college plans.

“To get students to complete anything was challenging,” said Patty Williams-Downs, executive director of the Houston affiliate of OneGoal, a nonprofit that works with schools in six cities to help students plan for college. “The desire to go to college and not experience what you had anticipated a year ago was flattening.”

Some students decided not to enroll because they didn’t want to learn online and others were concerned about catching COVID-19 on campus and taking it home to family members.

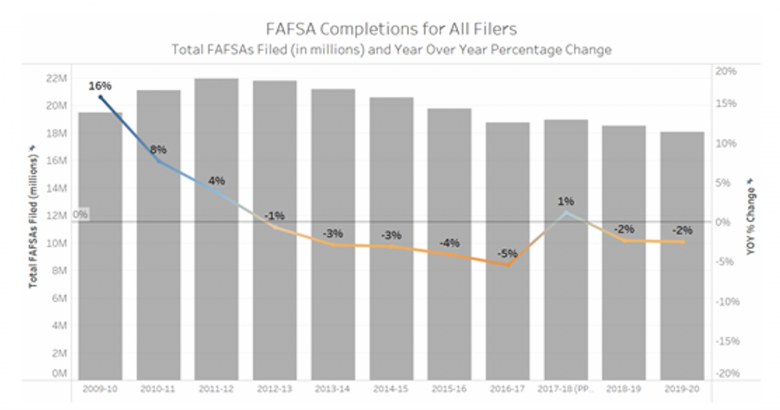

FAFSA completion rates were trending downward even before the pandemic, according to additional data the network released Monday. The only year-over-year increase in rates since 2012-13 came in 2017-18. In that year, Federal Student Aid made the form available three months earlier and began allowing applications to submit tax return information from the prior year, but those incentives didn’t stop a pandemic-related decline.

Requiring FAFSA completion for high school graduation has been a more recent state policy trend, with the goal of removing barriers to college enrollment.

Louisiana, which became the first state to require FAFSA completion for graduation in 2018, has the highest filing rate so far this year with almost 74 percent of the senior class, followed by Tennessee at 72 percent and Washington, D.C. with 69 percent.

Several more states have since either passed or considered legislation, but such requirements, DeBaun said, should come with training and support for counselors and school personnel helping students through the process. He’s encouraged by a new law in Colorado that provides grants to districts that make FAFSA completion a graduation requirement. And in Michigan, education officials plan to spend federal relief funds on hiring more high school counselors and have made FAFSA outreach to families part of their recovery plan.

With college planning, “relationships pre-COVID mattered and post-COVID definitely matter,” said Williams-Downs. OneGoal teachers begin focusing on college readiness in students’ junior year and continue through the transition to college. The Houston site’s FAFSA completion rate among the 2,500 students served is usually 87 percent. It dropped this year to 76 percent, but Williams-Downs said it could have been a lot worse.

At the federal level, the focus has been on simplifying the FAFSA by slashing the number of questions from over 100 to 36 and increasing the amount low-income students can receive through Pell Grants. But the revisions included in a December pandemic relief package won’t go into effect until 2024-25, a year later than the law intended.

The U.S. Department of Education, however, took short-term steps last week to cut red tape for this year’s applicants, by temporarily suspending a financial verification process. The department estimates the change could help about 200,000 minority and low-income students.

“This has been an exceptionally tough year,” Richard Cordray, chief operating officer of Federal Student Aid, said in a statement. “We need to ensure students have the most straightforward path to acquiring the financial aid they need to enroll in college and continue their path to a degree.

Get stories like these delivered straight to your inbox. Sign up for The 74 Newsletter

;)