In Dozens of Districts, Teachers Can’t Afford to Live Near Their Schools

Aldeman: District spending is up, but educator pay isn't. Efforts to provide affordable housing for teachers have run into trouble

By Chad Aldeman | June 2, 2025In a recent analysis, Katherine Bowser of the National Council on Teacher Quality finds that teachers are increasingly being priced out of housing in their communities. She notes that, between 2019 and 2024, the percentage growth in home prices and the cost of renting a one-bedroom apartment have significantly outpaced increases in both inflation and teacher salaries.

In short, teachers face, “a widening gap between income and housing affordability,” according to NCTQ President Heather Peske.

The U.S. Department of Housing and Urban Development defines “affordable” as “paying no more than 30% of gross income for housing costs, including utilities.” NCTQ had previously looked at a select sample of 69 large urban districts and found 18 where beginning teacher salaries met the definition for “unaffordable” as of 2019.

By 2024, that number had risen to 39, or about half the sample. In 10 of those districts, the rent for a one-bedroom apartment cost 40% of a beginning teacher’s salary. In Boston, for example, it would eat up nearly 43%.

Bowser notes that the picture today is even grimmer when looking at a teacher’s prospects for purchasing a home. Using some (ambitious) estimates about how much an educator could save toward a down payment on a mortgage and comparing it with local real estate prices, Bowser finds that teachers would struggle to purchase a home in 54 out of 56 sample districts.

These are extreme numbers. But who or what is to blame? And what can be done?

One potential solution starts with a simple premise. If teachers can’t find affordable housing, school districts could partner with developers to build apartments and become landlords to their own employees. This has been a particular focus in California, where state Superintendent of Public Education Tony Thurmond and a coalition of legislators and developers are encouraging districts to repurpose empty buildings and unused land to address housing needs.

That may seem like a good idea at first blush, but previous efforts have been plagued by delays and rules that prevent “low-income” housing subsidies from going to people who are not truly low-income. In other words, teachers often make too much to qualify for extra financial assistance.

The idea that districts can solve teacher housing issues is also complicated by the fact that educators are far from the only group of workers who struggle to make ends meet in high-cost urban areas. Indeed, recent studies have found that high housing costs have led to lower mobility and fewer opportunities for people to climb the economic ladder. If police officers, social workers, janitors and cleaners, bus drivers, food service workers and many other types of low- and moderate-income employees are all being priced out of many American cities, there’s only so much a school board can do. In that case, the “teacher” housing problem is largely a generic, community-wide affordability problem that will be solved only by building more housing units.

But even if individual school boards cannot solve this big, societal trend, education policymakers are not helping. In fact, their choices have made the housing affordability problem worse. How? By not turning rising revenues into higher salaries, they’ve chosen to prioritize a larger education workforce over a better-paid one. In turn, that makes it harder for teachers and other school employees to afford housing in the places where they work.

As I noted in a recent project for The 74, school spending is keeping up with or even outpacing inflation in many parts of the country, but those investments are not translating into higher compensation for district employees. If those salaries had merely kept up with total education spending, they would be 34% higher. At the national level, that would have worked out to a $22,000 raise for the average school employee.

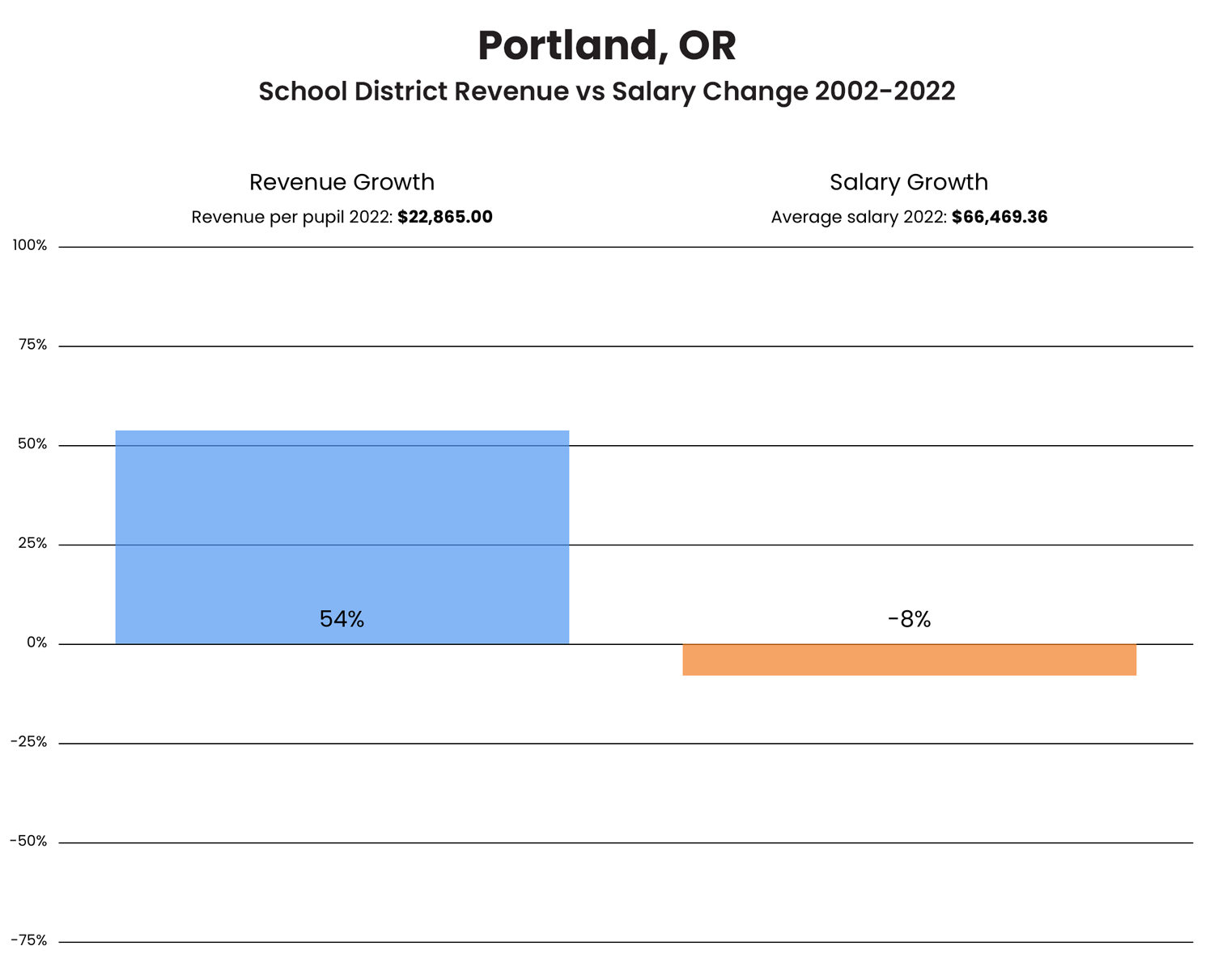

In Portland, Oregon, for example, NCTQ’s Bowser finds that it would take 41% of a beginning teacher’s salary to rent a one-bedroom apartment. But that’s not for lack of investments in the district. As we found in our report, Portland’s revenues rose 54% from 2002 to 2022 in inflation-adjusted, per-pupil terms. (That is, the district revenues increased much faster than inflation.) And yet, the average salary paid to Portland school employees fell by 8%. Portland, like many parts of the country, did not turn budget increases into salary gains for its workers.

These trends have continued in recent years. While Portland housing prices surged over the last five years, the district lost 10% of its student enrollment. At the same time, it added the equivalent of 445 full-time employees to its payroll (an 8% increase). In other words, instead of leaning into the housing problem and trying to pay its existing workers higher salaries, the Portland school district actually made the city’s housing problems just a bit worse by hiring more, lower-paid workers.

I don’t want to just pick on Portland here. As we showed in our project last month, 90% of districts are making these types of choices. But they effectively mean that school district leaders in some of the biggest, most expensive places to live are making budgetary decisions that add to the housing difficulties in their communities.

Get stories like these delivered straight to your inbox. Sign up for The 74 Newsletter