Big Tax Bill Passes — With Less ‘Beautiful’ Plan for National School Choice

House members must now wrestle with scaled-back proposal, which no longer requires states to participate.

Get stories like this delivered straight to your inbox. Sign up for The 74 Newsletter

Updated July 3

After more than 24 hours of negotiations and a record-setting speech from Democratic Minority Leader Hakeem Jeffries opposing the “Big, Beautiful Bill,” the House on Thursday passed President Donald Trump’s tax-and-spending package by a 218 to 214 vote. The president plans to sign the legislation on July 4.

The House made no changes to the bill after the Senate passed it Tuesday, despite opposition from Republicans who thought it strayed too far from the version they passed in late May. Rep Keith Self of Texas posted on X that their original tax credit scholarship proposal would have created a national voucher program, while the Senate version “leaves blue state students in failing schools with ‘optional’ school choice.” He still voted for the bill, but two Republicans voted against it — Rep. Brian Fitzpatrick of Pennsylvania and Rep. Thomas Massie of Kentucky.

Sen. Bill Cassidy of Louisiana, who sponsored the school choice provision, said “enshrining the first ever federal school choice provision into our nation’s tax code is a major win. We will continue to advocate for and pass improvements moving forward.”

The Senate on Tuesday passed the nation’s first federal tax credit scholarship program as part of a massive tax and spending bill President Donald Trump wants to sign by July 4.

But the provision is significantly watered down from the one school choice advocates have been working toward since the first Trump administration. As it currently stands, states may opt in, meaning many Democratic-majority states probably won’t participate.

Jim Blew, co-founder of the Defense of Freedom Institute, a conservative think tank, called the Senate passage “an important step toward making sure every family and teacher in our country enjoys education freedom.” But the restrictions, he said, will “make it very, very hard to put funds into the hands of families who just want to get their children in a better school.”

House staff began deliberations over the bill immediately, with a vote expected Wednesday. But it’s unclear how members will greet the revamped choice plan.

The plan grants donors to scholarship organizations a tax credit for the same amount they contribute. Those nonprofits then award funds to families for private school tuition and other educational expenses. But unlike the more expansive plan the House passed in late May, the Senate gives states a say over which groups can participate and strikes language that would have prohibited any control over private schools. That could be a major sticking point for House members, said Joshua Cowen, an education professor at Michigan State University and a vocal voucher opponent.

“Maybe they’ll just hold their nose and pass it,” he said. But that would come at the cost of “the most wide-ranging federal regulations we’d ever see on private and religious K-12 schools.”

Texas Sen. Ted Cruz, a longtime supporter of tax credits for school choice, didn’t mention the revisions when he addressed the chamber during the early morning hours Tuesday after members worked on Trump’s “one big beautiful bill” through the night.

“This tax credit provision will unleash billions of dollars every single year for scholarships for kids to attend the K-through-12 school of their choice,” he said, calling school choice “the civil rights issue of the 21st century.”

The new program is just a small part of a legislative package that continues Trump’s 2017 tax cuts and could add at least $3 trillion to the national debt by 2034. With a trifecta in Congress and the White House, Republicans passed the bill in a party-line vote. But Vice President J.D. Vance still had to break a 50-50 tie in the Senate after opposition from Republican Sens. Rand Paul of Kentucky, Thom Tillis of North Carolina and Susan Collins of Maine.

Child tax credits and Trump accounts

The legislation includes other child-related provisions, including the extension of an existing $2,000 child tax credit. The House version boosts it to $2,500, while the Senate version increases the credit to $2,200. “Trump accounts,” a new feature, would provide a $1,000 investment fund for children that they could later use for education or a house.

Among the most controversial changes are cuts and work requirements for Medicaid and food assistance programs for low-income families. The $1 trillion proposed cut to Medicaid could especially impact children in rural areas who are more likely to depend on the program for health care.

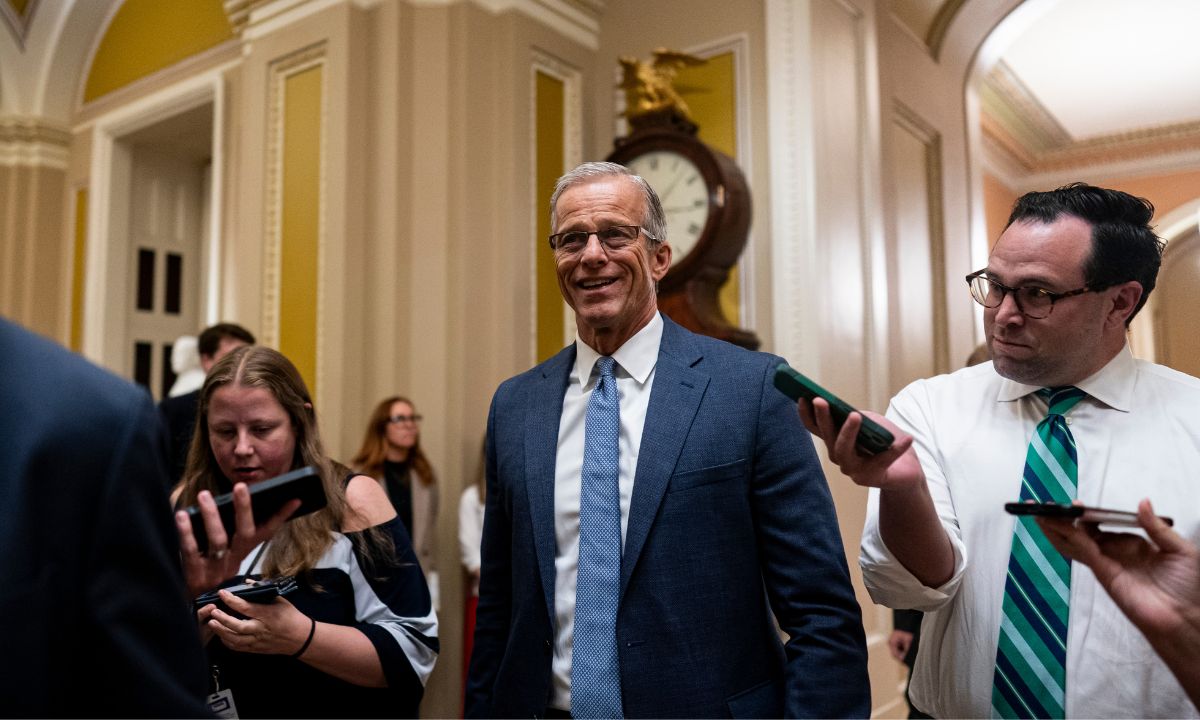

On the Senate floor Monday morning, Senate Majority Leader John Thune said the “reforms” make the program more efficient by targeting “people who are supposed to benefit from Medicaid.” But Democratic Sen. Ron Wyden of Oregon, ranking member of the finance committee, warned: “Kids with disabilities will lose health care.”

Those provisions have generated far more debate among GOP members than the school choice provision. But Republicans made significant changes to that portion after a Senate official ruled Thursday that it didn’t meet the standards for reconciliation and would require 60 votes to pass. In addition to allowing government oversight, Republicans dropped the total amount a donor can contribute from 10% of their annual income to $1,700.

“To raise $1.7 million for scholarships, [organizations]need to identify 1,000 donors, which is a lot harder to do,” Blew said. “That wasn’t done to help students or families.”

Multiple questions remain over which families stand to benefit the most from the program. Some existing scholarship groups target funds to low-income students, but the federal program lacks such a requirement.

The bill sets eligibility at 300% of median income, meaning that in higher-income areas, families earning nearly half a million dollars could use the scholarships. Preference for the scholarships would also go to students who received them the previous year or to their siblings, contributing to concerns that families who already have their children in private schools would be more likely to receive a voucher.

“You can be a very wealthy family in a very wealthy area and still be eligible for [these] funds,” said Jon Valant, director of the Brown Center on Education Policy at the left-leaning Brookings Institution. “Who knows exactly how this is going to play out.”

DeVos calls it a ‘win’

Supporters say the program will bring private school choice to students nationwide at a time of increasing demand. Tennessee’s newly expanded voucher program, for example, received roughly 33,000 applications in the first few hours it was open on May 15, creating technical glitches

Opponents argue the program allows donors to avoid taxes and would fund tuition at schools that discriminate against students.

The House version, Cowan said, “rams” vouchers into states like Michigan that have rejected them since 2000. Michigan billionaire Betsy DeVos, who promoted a similar federal plan as education secretary during Trump’s first term, failed to get a voucher initiative on the ballot in 2023. Kentucky and Colorado said no to private school choice initiatives last November, and Nebraska voters repealed a program lawmakers passed in that state in 2024.

In other states — Ohio, South Carolina and Utah — judges have ruled that voucher programs violate the law.

On Tuesday, DeVos sounded a triumphant note, calling the Senate passage “a major win for students and families” on X.

Cowan said the vote would not give the former secretary “her long-sought after goal of forcing vouchers into the states using the tax code” and gives “substantial authority to state governors and perhaps [education] agencies to say ‘no.’ ”

Education Secretary Linda McMahon welcomed a provision that limits student loans for college, but had nothing to say about the school choice aspect of the bill.

Critics frequently cite the scarcity of private schools in rural areas as the reason they oppose vouchers. A data analysis from the Urban Institute shows that over 60% of students in urban areas live within two miles of a private school, compared with just a quarter of students in rural areas.

Participation in the new program depends on how many families apply and the size of scholarships. Historically, take up rates have been relatively low with new voucher programs, said Colyn Ritter, a senior research associate at EdChoice, an advocacy organization.

If scholarships are large enough to cover the full ride to some private schools, which averages about $12,000 nationwide, more families might seek a scholarship, Ritter said. But that amount wouldn’t be enough to afford more expensive schools in the Northeast.

If scholarship awards are as low as $2,500, that might offer a cut on tuition for families who can make up the difference, but it wouldn’t be enough to make private school an option for a family in poverty, he said.

Families could use the scholarships for homeschooling costs, like tutoring, curriculum and educational therapies. But Ritter called homeschoolers a “hard-to-predict” group. The population has grown more diverse racially and politically. Some, he said, could be “early adopters” of the new funds, but many homeschoolers are still leery of government-run programs.

“We just want to make sure that there are no strings attached and that we won’t end up in some government database that can track us and tell us what to do in the future,” said Faith Howe, president of Texans for Homeschool Freedom.

The Children’s Scholarship Fund in New York is one of the nonprofits that would likely participate in the program. The group has affiliates in 23 states, including several blue states, that are closely watching negotiations over the final wording, said spokeswoman Elizabeth Toomey.

Her organization has a small homeschool pilot program and might take advantage of the new legislation to expand it. Forty families currently receive $1,000 to spend on approved expenses through the ClassWallet platform, the same way many state education savings accounts operate. But the group’s core mission, Toomey said, is awarding roughly 7,000 scholarships each year to students from low-income families across New York City.

Recipients receive, on average, about $2,500 toward tuition, but Toomey said the new federal program would allow the organization to increase the award and serve more families. She acknowledged that a scholarship might not help the “poorest of the poor,” but has helped push many families “into a position where they can afford private school.”

Get stories like these delivered straight to your inbox. Sign up for The 74 Newsletter

;)