Tutoring Giant’s Sudden Demise Linked to End of Federal Relief Funds

FEV Tutor was a 'massive player’ in the field, once worth $40 million in contracts from California to Florida. On Saturday, it abruptly closed.

Get stories like this delivered straight to your inbox. Sign up for The 74 Newsletter

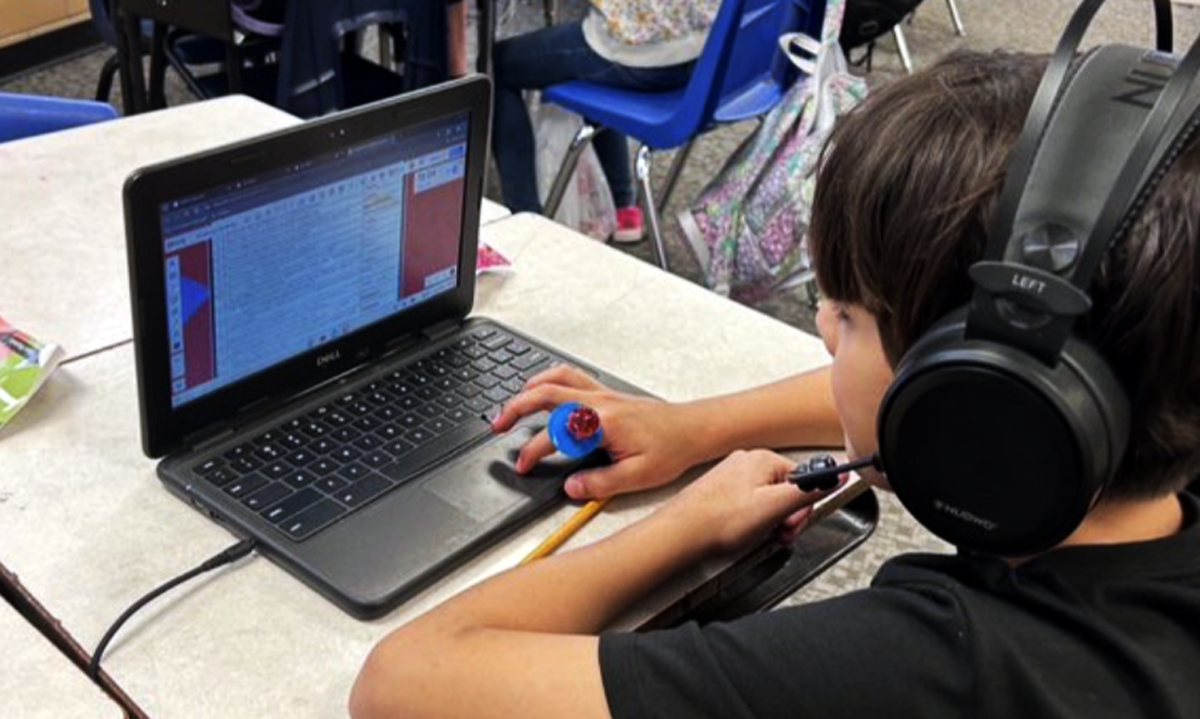

One of the nation’s leading tutoring providers shut down abruptly over the weekend, temporarily leaving thousands of students without the extra support they’ve depended on since the pandemic.

FEV Tutor, a chat-based, virtual tutoring firm with contracts in districts from California to Florida alerted staff on Saturday that efforts to raise more money or find a buyer had failed. CEO Reed Overfelt cited “worse-than-expected company performance” in his message to employees.

Some districts promptly alerted families about the interruption in services. The Henrico County Public Schools in Virginia referred parents to other tutors, including teachers, “to minimize the impact of FEV’s closure.” The Ector County Independent School District in Texas asked its other provider, Air Tutors, if it could take on the 2,000 students FEV left behind.

“We found this all out on Sunday,” said Ector spokesman Michael Adkins. “We’ll have to work very quickly to change things over, but as of today, we are expecting we will be able to find a virtual tutor for all of our kids.”

‘Too fast, too quickly’

While districts and other tutoring providers might be able to cobble solutions together, FEV’s demise is one of the more visible early signs of what school finance experts warned would happen when nearly $190 billion in pandemic relief funds ran out. Districts have less money to spend on vendor contracts, leaving companies that were in high demand a year ago having to rethink their futures. Those that expanded at a rapid clip, like FEV Tutor, could be particularly vulnerable.

“We saw what you would expect with large government programs — a lot of folks rushing out with various models,” said Adam Newman, founder and managing partner of Tyton Partners, a consulting firm. “A lot of those organizations grew too fast, too quickly.”

With district contracts in at least 30 states and an estimated value of over $40 million, FEV Tutor was an “early innovator in providing virtual tutoring services” through an on-demand, chat-based platform, Newman said. With customers including the New York, Baltimore and Dallas school districts, the company gave tutors access to an AI coach and engaged in innovative contracts in which tutors earned higher rates when students showed greater improvement.

They were “massive players” in the industry, and when districts started spending their relief funds , FEV was “very well-positioned to win all these district [contracts],” added John Failla, founder and CEO of Pearl, a company that helps districts manage tutoring programs. “They scaled up like crazy.”

But while its closing was unexpected, the financial reality that caused it was not.

A year ago, one expert noted that investments in ed tech had dropped back to pre-pandemic levels. Even in late 2022, “rising inflation, interest rates, geopolitical crises and belt-tightening brought an end to the copious amounts of capital that defined the pandemic,” wrote Tony Wan, head of platform at Reach Capital. Districts were already “preparing the chopping block for tools and services” that were nice to have but no longer necessary.

Some districts also just prefer to manage their own tutoring programs.

“If you look at the districts [that] have succeeded in scaling tutoring the most, all of those have owned a lot of the process internally,” said Liz Cohen, policy director at FutureEd, a Georgetown University think tank. She cited Baltimore City, Guilford County, North Carolina, and Nashville as examples. “Districts are increasingly focused on the relational part of tutoring. It can be virtual or in person, but it’s someone who has a face and a name and that the kid knows.”

The surprise isn’t that FEV Tutor is a “casualty” of the fiscal cliff, she said. “But certainly, nobody expected them to shut down on a Saturday in the middle of the school year when they have active customers and employees.”

FEV Tutor did not respond to an email requesting comment. A red banner at the top of its home page says the company “ceased operations” on Jan. 25.

The news clearly confused some parents. In response to an announcement on Facebook, some families in Harford County, Maryland, blamed the district and wondered if officials knew weeks ago that services would end so suddenly. Another wrote, “There’s clearly a mismanagement of money somewhere.”

On the district’s website, officials apologized for the disruption, saying they could not guarantee they would be able to “find or implement a comparable solution at this time.”

Marguerite Roza, the director of Georgetown University’s Edunomics Lab, said she hasn’t seen other pandemic-era vendors face such a dramatic end, but predicted “there will be more in the coming months.”

Return on investment

Software industry veterans Anirudh Baheti and Ryan Patenaude founded FEV Tutor in 2008, well before the pandemic. According to GovSpend, a data company, annual sales didn’t top $1 million until 2018. By 2021, as districts began spending relief funds, sales jumped to over $6.3 million.

In 2022, Alpine Investors, a private equity firm, acquired the company, and Patenaude said in a press release that he was excited about the “next stage of FEV’s growth.” Jim Tormey, an executive with Alpine, stepped in as CEO until Overfelt took over in 2023.

FEV’s work in Ector and Duval County, Florida, was also part of an innovative arrangement known as outcomes-based contracting. The company didn’t just deliver tutoring; it promised better results for more money, and offered to take a pay cut if students didn’t make progress.

Such deals piqued the tutoring world’s interest in recent years as policymakers increasingly called for evidence that relief funds weren’t going to waste. Cohen, who featured FEV’s work last year in a FutureEd report on tutoring, wrote in a commentary that the concept could help ensure districts “get the best return on their investment and help build a culture of performance in public education.”

FEV Tutor further evolved last year when it announced a new AI-enhanced platform, Tutor CoPilot. The tool makes tutors more effective by giving them guiding questions to ask students. In a randomized trial, the National Student Support Accelerator at Stanford University, which studies tutoring models, found that when less-experienced tutors used the AI support, student math scores increased an average of 9 percentage points.

But that breakthrough apparently wasn’t enough to turn business around.

In his note to the company, Overfelt said he and the board of directors had “explored every possible avenue to secure FEV Tutor’s future,” but that talks with additional investors had “reached their end.”

Since FEV was on a pay-as-you-go contract, Adkins, in Ector, said the district wasn’t worried about losing money.

But FEV employees are suddenly out of a job. A customer service manager who once taught in the Las Vegas-area Clark County schools posted on LinkedIn that she was looking for work. And Jen Mendelsohn, CEO of Braintrust Tutors, said she spent Monday interviewing former FEV employees.

Many, she said, “have long-term district relationships nationwide and are looking for ways to ensure academic continuity for their students.”

Get stories like these delivered straight to your inbox. Sign up for The 74 Newsletter

;)