New Report Details Importance of Personal Finance Education in High Schools

The North Carolina legislature passed a law in 2019 requiring financial literacy discussions in schools.

Get stories like this delivered straight to your inbox. Sign up for The 74 Newsletter

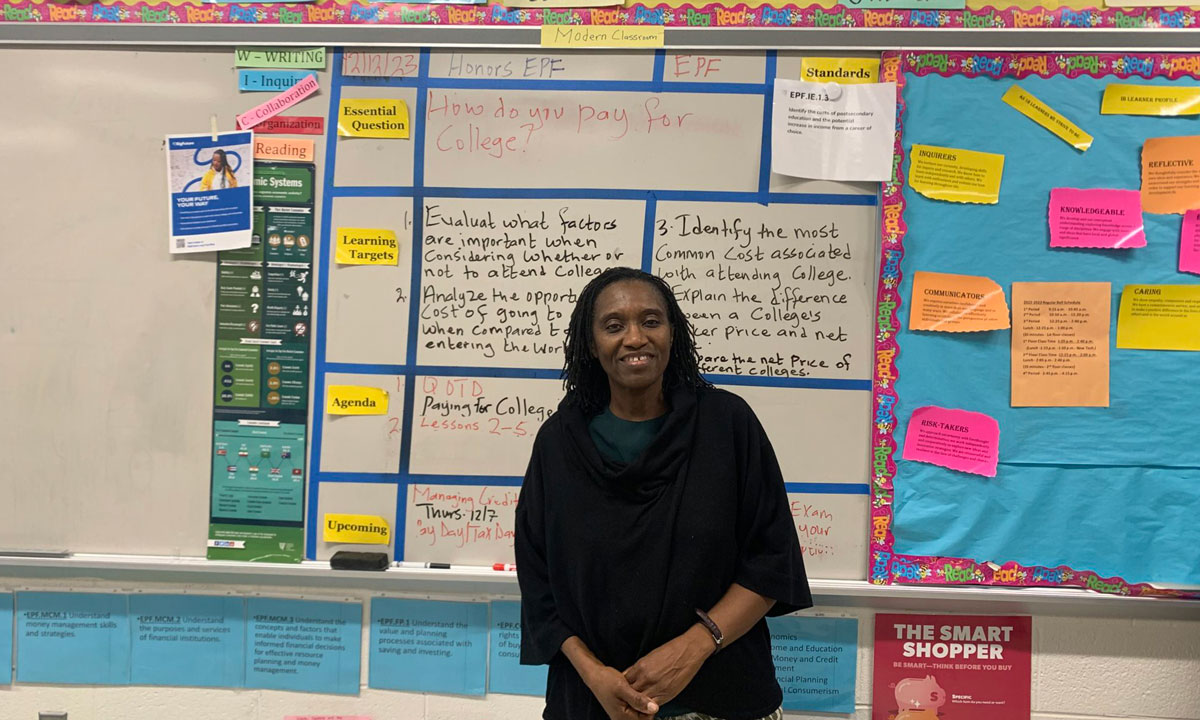

One day, students at Hillside High School were greeted in Shianyisimi Ogede’s economics and personal finance class with the question: “What percentage of students get financial aid?” With this year’s Free Application for Federal Student Aid (FAFSA) opening in December instead of October, financing education after high school is one of the many topics she covers with her 10th and 12th grade students.

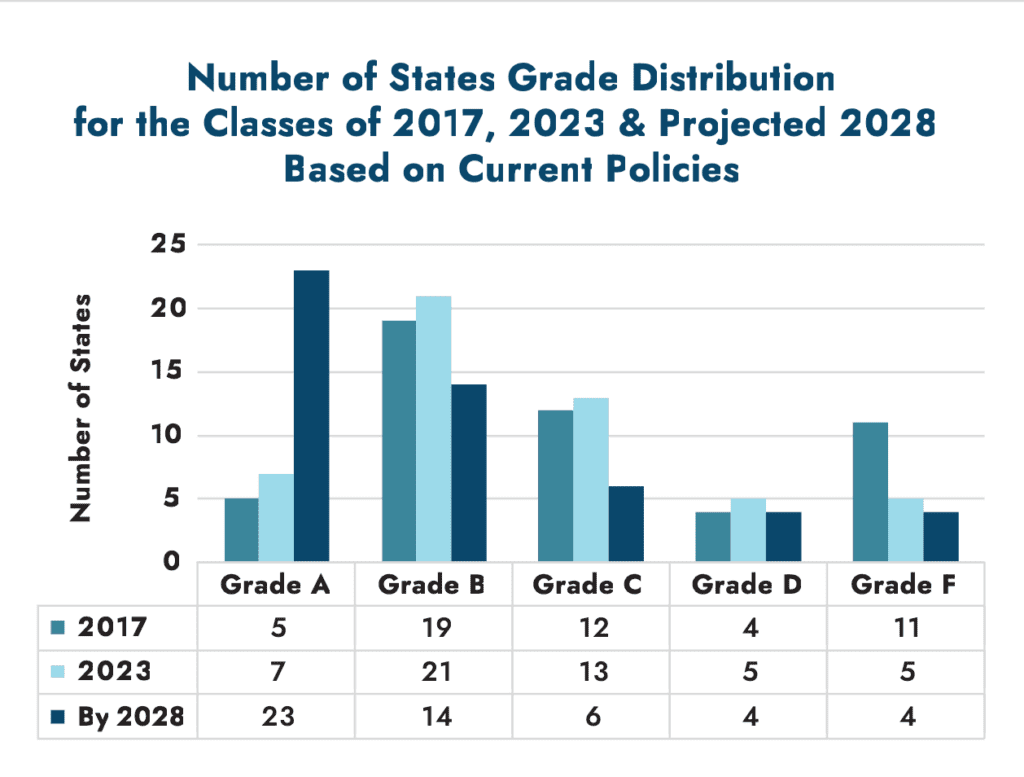

In early December, the Center for Financial Literacy at Champlain College in Vermont released a report card, grading each state on its delivery of personal finance education in high school. According to the report, these courses are increasingly being offered in schools across the country after the pandemic highlighted the extent of income inequality. More concern about students learning about loans for college and filling out the FAFSA has also been an influence.

The report says that high school financial instruction improves credit scores, lowers loan delinquency rates, and reduces the use of risky services such as payday lending.

Seven states earned an “A” grade based on how well they guaranteed and executed access to a course focused on personal finance for students that graduated from high school in the spring of 2023. The center projects that in five years, 23 states will meet the same standard — with North Carolina being one of them. Now, along with 41% of other states, North Carolina sits at a “B.”

Preparation for these courses has been aided by the increase of free online curricular courses offered by state departments of education and other organizations. The report projects that there will be a need for 30,000 highly trained personal finance educators in the states that earned an A or B grade by 2028.

The North Carolina legislature passed a law in 2019 requiring financial literacy discussions in schools as a graduation requirement.

During summer 2020, the North Carolina Council on Economic Education offered virtual professional development for the new course. This 40-hour professional development included presentations from NCCEE, NextGen Personal Finance, The Federal Reserve Bank of Richmond, and Marginal Revolution University. The five-day training consisted of a pretest, group activities, and a post test, as well as access to free resources to help them teach the course.

Sandy Wheat, executive director of the NCCEE, said that teachers gained more confidence about their own financial well-being after the training.

“We have teachers who report that they’re going to pay down unsecured debt because they didn’t really understand how the compound interest was working against them. And at the same time, they’re learning how compound interest works for them when they’re investing,” Wheat said.

The number of financial decisions that students have to make increases during and especially after high school. Meanwhile, the report found most parents do not feel financially savvy enough to discuss financial matters with their children at home, leaving schools to foot the education bill.

The report found large disparities in financial capability among different groups in the United States. According to the report, without state requirements for a standalone course, schools with higher fractions of students of color are less likely to have access to a required personal finance courses or content.

Along with covering student loans and financial aid, Ogede said her students learn the importance of investing and managing their credit. They complete an extra credit project with students from Duke University by way of the First Generation Investors program, where they decide how to split $100 between stocks, bonds, and companies that they have a personal interest in. At the end of the course, they get the $100 transferred to their personal name.

“In America, wealth is connected with your credit score, because if they don’t have a good credit score, you’re going to get a higher interest rate,” Ogede said. “You’ll find that most of the time, there are parents that passed knowledge back to them, you know, there are grandparents who invested, and they and the parents invested, and they taught the children. Now, when you come to the Brown and Black population, it was not their history, because they didn’t grow up in that, it wasn’t passed down to them that way.”

Wheat said that the financial landscape has become more complex, causing more concerns for students.

“You know, it wasn’t too long ago that people would go to work for a company and work 25 or 30 years and retire with a pension and live happily ever after. With the reduction in corporate benefits, people are more and more responsible for their own financial futures,” Wheat said.

“People can’t do the right thing if they don’t know what the right thing is.”

Wheat said she believes that offering a personal finance course is another way for teachers to focus on what their communities need the most.

“I mean, think about if you’re navigating a ship with a compass, and you alter it by one degree, you’re going to wind up somewhere completely different than you intended to go or then you were bound for,” Wheat said. “So if you can take students that are thinking of dropping out of school, and you can convince them that their earning power is going to increase if they’ll just stay in school, then that’s a win. If you’ve gotten them to graduate, but then you have students who they’re going to graduate, but then what? This course gives them the opportunity to explore what’s next after school.”

Teachers who went through the training with NCCEE gave positive feedback. Wheat said students never ask teachers, “How will I use this in real life?”

To learn more about financial literacy requirements in the state of North Carolina, read the education standards here.

This article first appeared on EducationNC and is republished here under a Creative Commons license.

Get stories like these delivered straight to your inbox. Sign up for The 74 Newsletter

;)