Final Push to Save Expanded Child Tax Credit as Senate Hopes Dim

The bipartisan tax package, which sailed through the House in January, is projected to benefit 16 million poor children in the first year.

Get stories like this delivered straight to your inbox. Sign up for The 74 Newsletter

The last time Congress increased the child tax credit — during the pandemic — Sarah Izabel used the extra cash to enroll her son in an afterschool program so she could apply to graduate school.

“If my son was home, then I would be taking care of him,” said the Stanford University student, who’s now working on a doctorate in neuroscience. “These programs really support people as they’re improving their lives.”

She was among the parents and advocates who celebrated in January when the oft-gridlocked House overwhelmingly passed a tax package that includes a new increase for the program — one that experts project would benefit roughly 16 million poor children in the first year. But the plan has hit an unexpected wall in the Senate where some Republicans are hoping to kill it.

“The chamber we never thought we would be waiting on is the Senate,” said Ariel Taylor Smith, senior director of policy and action for the National Parents Union, one of several organizations ramping up pressure on skeptical Republicans before they return from recess April 8. She’s opposed to lawmakers revising the bill in order to appease opponents. “It will delay aid for families at a time when peanut butter costs $8.”

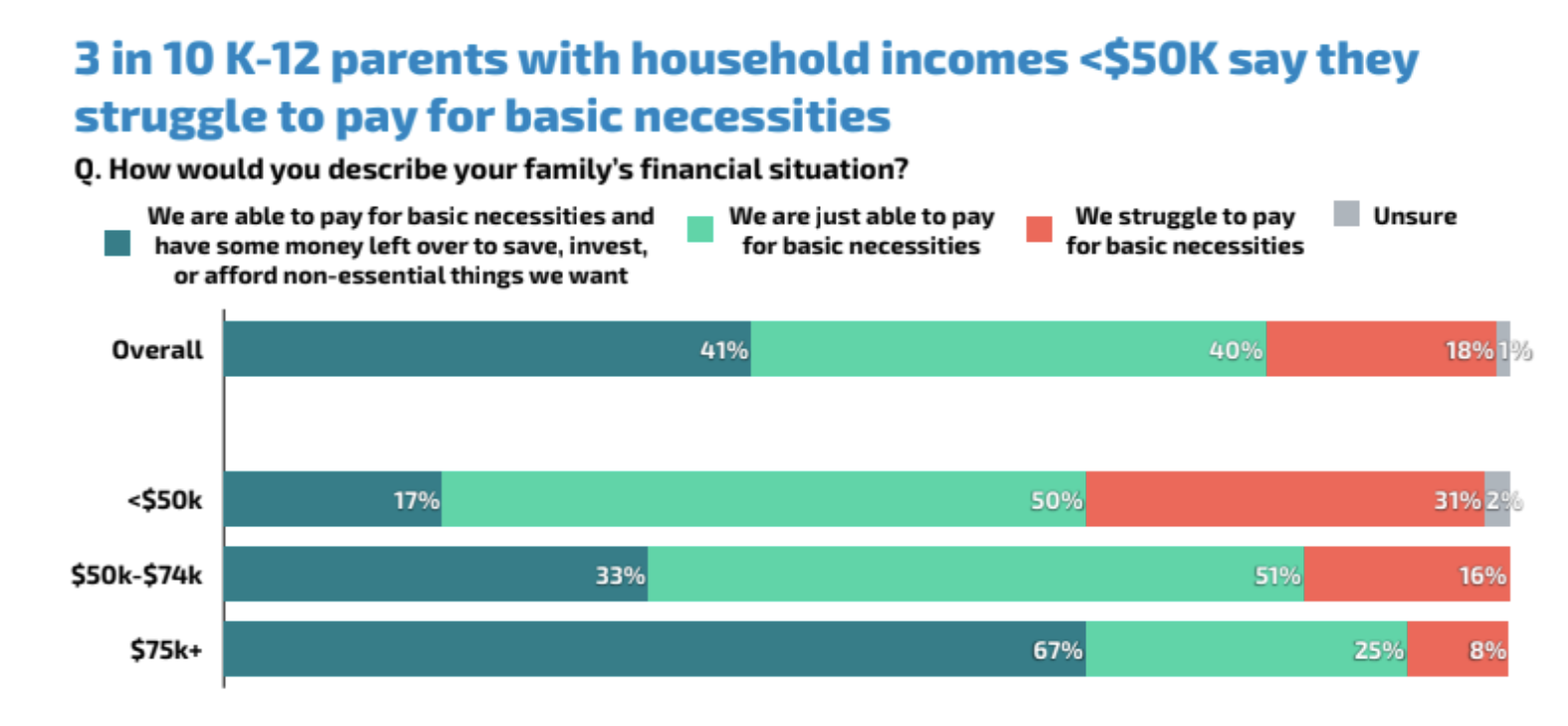

If the measure doesn’t pass, it could be well over a year before Congress takes up a similar proposal. That’s when they’ll consider renewing the Trump-era tax law, which doubled the child tax credit to $2,000 and expires at the end of 2025. But advocates say families need “more breathing room” now as inflation continues to strain household budgets. The proposed child tax credit, which would apply to the 2023 taxes families are filing this spring, is not as expansive as one Congress passed in 2021. But experts say it would help bring down child poverty, which has jumped since the larger benefit ran out.

“I think this is the best chance we have of passing the tax package this year,” said Elyssa Schmier, a vice president for government relations with MomsRising, an advocacy group. “We hear from families every day that are struggling to afford child care, medicine for their children, groceries and rent. Any way we can provide them support… in a timely manner, not only benefits moms, families and children, but the local economy as well.”

The 2021 pandemic credit, which allowed families to receive up to $3,600 per child, split into monthly payments, cut child poverty in half, Census data showed. As a parent living “paycheck to paycheck,” Izabel said the monthly payments allowed her to rely less on food pantries.

But Democrats failed to get Congress to make that level of support permanent.

Senate finance Chair Ron Wyden of Oregon, a Democrat, and Rep. Jason Smith, a Missouri Republican who leads the House Ways and Means Committee, struck the current bipartisan deal. The proposal would gradually increase the refundable limit of $1,600 per child to $2,000 by 2025 and allow parents to get the maximum benefit for each of their children. Right now, the more children in a family, the more parents have to earn to get the full credit.

For example, a single mother of two earning $15,000 a year receives $1,875 under the existing 2017 rate, but under the Wyden-Smith proposal, would receive $3,600 on her 2023 taxes and $3,750 the following year.

But Sen. Mike Crapo of Idaho, the ranking Republican on the finance committee, strongly objects to a provision that would allow families to still earn the credit even if they work less. He thinks it turns the program into an entitlement program instead of one that rewards work. Wyden has offered to drop the provision.

The bill needs 60 votes to overcome a filibuster and get to a floor vote. But experts say it’s unlikely Majority Leader Chuck Schumer would advance the legislation unless he’s confident it would pass. Republican Sen. Todd Young of Indiana is among those still in favor of the plan, which also includes tax incentives for businesses. But so far, Senate Minority Leader Mitch McConnell seems to be backing Crapo’s position.

“There are easily 10 Republicans who like the bill, but [it’s] unclear if they will vote yes without leadership being on board,” said David Plasterer, a senior associate at Results, an anti-poverty nonprofit. “The hope is that businesses and constituents will be all over Senate Republicans.”

‘Economic impact’

Democrats wanted to see relief for families similar to the 2021 expansion. That’s why Rep. Rosa DeLauro of Connecticut, who voted against the House bill, called it “a watered-down policy for the sake of making a deal.”

The monthly payment provision, Plasterer said, was especially important to families with school-age children, who used the funds for basic needs like food and rent, but also spent it on child care, afterschool programs and educational materials.

But there’s also an advantage to getting a bigger tax refund — especially when it comes to education, he said. The extra money can go towards buying a car, which can help alleviate some of the transportation challenges that exacerbate chronic absenteeism, particularly in rural areas, he said.

Originally from rural Indiana, where he worked with low-income fathers at a social service agency, he said the only time during the year when families had thousands of dollars available was when they received their tax refund.

“Those families are doing repairs to their car, or buying a used car,” he said. “If you don’t have a car, you can’t get to school.”

Polling conducted by the National Parents Union shows broad support among parents from both parties for expanding the tax credit. With the pro-business benefits in the plan, like deductions for research and development, Smith said she doesn’t understand why some Republicans aren’t on board.

“When you think about the economic impact of the total package,” she said, “it should be a no brainer.”

Get stories like these delivered straight to your inbox. Sign up for The 74 Newsletter

;)