If Phil Murphy Doesn’t Succeed Where Seven Former Governors Failed on Pension Costs, Is New Jersey Headed for Fiscal Catastrophe?

Newly minted Gov. Phil Murphy of New Jersey, who takes his oath of office in Trenton on Tuesday, has begun his political career with immense promise.

The former financier, diplomat, and first-time candidate outmaneuvered several prominent opponents to bring the traditionally blue state back under unified Democratic control for the first time since 2009. Now he’s pursuing a first-term agenda that reads like a liberal wish list after nearly a decade of Republican rule, including a $15 minimum wage, tougher regulations on guns, and — perhaps most audacious — a dramatic increase in school funding. With Democratic majorities in both chambers of the state legislature, he’s in a strong position to realize some of those priorities.

And yet the celebration may soon come to an end.

That’s because even as Murphy’s administration takes shape, New Jersey is confronting a titanic struggle to bring its finances back to something resembling normalcy. Residents have carped about sky-high property taxes for years. The state’s credit rating was lowered 11 times during the past eight years. And its pension system for public employees, directed mostly toward hundreds of thousands of retired teachers, ranks with Illinois’s and Kentucky’s as the most underfunded in the nation. Cleaning out those Augean stables while moving the ball forward on his campaign promises will demand every ounce of the goodwill and credibility Murphy has hoarded for years.

Each of the past seven people who held Murphy’s job dealt with these challenges — though never one as immense as the current situation. All of them failed in ways large and small to disentangle New Jersey’s tortured finances. Whether Murphy is able to succeed where they fell short, or simply never tried, will determine his legacy in public life. Local observers view his prospects with a mixture of hope and realism.

“What Murphy has to do is unify the lobbyists, the legislature, teachers, homeowners — everyone — and say, ‘What we’re doing isn’t working, we have to fix it, and we’re all going to hurt a little bit,’ ” said Laura Waters, a local school board member and the author of a reform-minded blog on education policy and finance. “I know that’s nothing he’d say during a campaign. But it’s true, and if we don’t face up to that, our fiscal condition will continue to deteriorate.”

How we got here

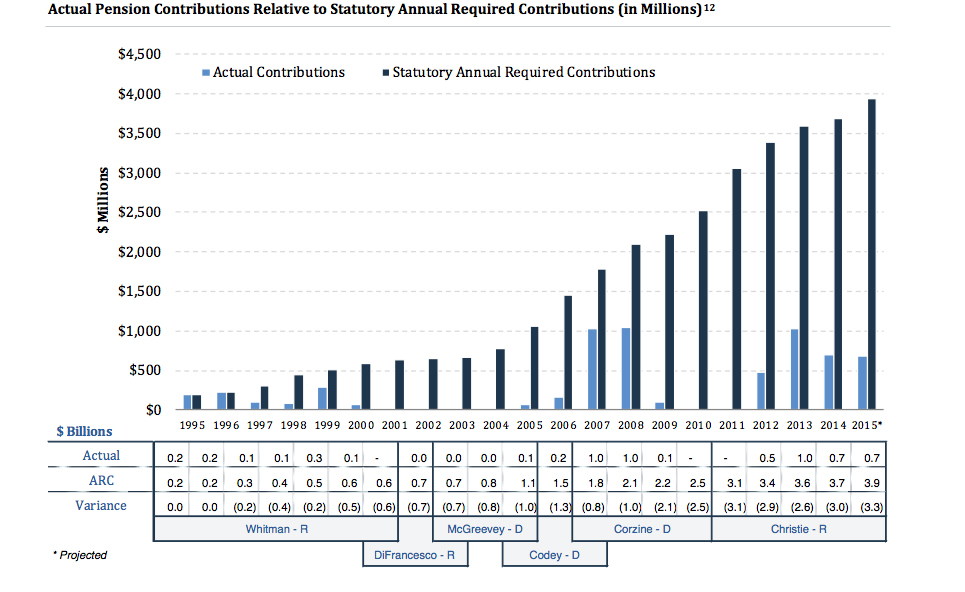

In 2014, then-Gov. Chris Christie impaneled a bipartisan commission to study New Jersey’s pension funding crisis, then roughly 18 years old. As a welcoming gift to his replacement, the group released its final report in December with harrowing projections about the system’s fiscal health. In spite of increased payments toward the pension fund over Christie’s final year in office, the state’s unfunded liability now sits at roughly $90 billion.

The commission attributes $79 billion alone to the Teachers’ Pension and Annuity Fund, which is only 22.3 percent funded. Teachers’ pensions are guarded jealously by their unions, most famously the NEA-affiliated New Jersey Education Association. Those pensions, and NJEA’s political interventions to protect them, are likely the biggest hurdles Murphy faces in restoring the state to long-term solvency.

The status quo is the product of labor successes and political failures.

Previous governors have so uniformly sidestepped the issue over the last two decades that apportioning blame has become a media pastime. Republican Christine Todd Whitman first lowered the state’s contributions to its pension fund in the 1990s in order to cut taxes and shrink a budget deficit; her Democratic successors Jim McGreevey and Richard Codey skipped payments altogether for a few years. As the problem grew, Democrat Jon Corzine — like Murphy, a former high-ranking executive at Goldman Sachs — began making some of the largest contributions in the history of the pension fund.

But he also pushed for a costly change to New Jersey’s education financing, called the School Funding Reform Act, that left the state on the hook for billions in new financial obligations. The SFRA was signed into law in January 2008; coincidentally, that month was when employment in New Jersey peaked, just before the onset of the Great Recession. Consequently, the new law has never been fully funded.

Chris Christie defeated Corzine in his bid for re-election in 2009 and struck a bargain with the public employees unions at the beginning of his term. He promised to fully fund the state’s pension fund in exchange for higher contributions from members and a later retirement age. When the sluggish recovery from the recession resulted in lower-than-expected tax receipts, though, he reneged on his end of the deal.

For its own part, the NJEA has proved a determined adversary of any lawmaker who has attempted to pare back its members’ benefits. It sued Christie in 2015 after he walked back his commitment on state contributions, then backed a constitutional amendment to guarantee full state funding of the pension system. When Democratic Senate president Steve Sweeney refused to bring it to the floor, it formed a bizarre alliance with his Republican opponent in last fall’s election, donating millions to the vocal Trump supporter in an effort to exact vengeance.

Undoubtedly wary of stirring a hornet’s nest, Murphy wouldn’t commit to pursuing renegotiations of health or retirement benefits while he was campaigning, instead insisting that it was principally the state’s obligation to make full contributions to the pension funds. In a local television interview last spring, he suggested using his financial expertise to claw back the managerial fees extracted by the funds’ Wall Street stewards.

“Unfortunately, I’m not optimistic about Murphy. Maybe he’ll govern differently from what he said. But Corzine doesn’t provide a good example. Well, no governor has, really.”

—Mike Lilley, NJ bond trader and American Enterprise Institute author

The new governor is perhaps uniquely familiar with the budgetary complexities. In 2005, as the chairman of an earlier pension commission enlisted by then-Gov. Richard Codey (now one of his strongest allies in the state Senate), he issued a study — ultimately unheeded — that called for massive reform.

“The problems that exist now are the same problems that existed then, only they were less extreme, less dire,” says Mike Lilley, a New Jersey bond trader and the author of several critical reports on NJEA for the conservative American Enterprise Institute. “So Murphy knows damn well what the problems are, yet he made these absurd promises about what he’s going to do.”

Whatever the political needs of Candidate Murphy in 2017, Gov. Murphy must contend with some intractable realities in 2018 to have any chance of setting the state on better financial footing. Lilley doesn’t hold out a great deal of hope.

“Corzine was a Wall Street guy, head of Goldman, and he was supposed to be smart about all this stuff, but he didn’t do a damn thing,” he said. “Unfortunately, I’m not optimistic about Murphy. Maybe he’ll govern differently from what he said. But Corzine doesn’t provide a good example.”

“Well, no governor has, really.”

Pot of gold

Murphy has set an ambitious course for his first hundred days in office. His foremost goal is to generate more revenue through two steps: legalizing and taxing marijuana, and increasing the income tax on the top-earning 1 percent of New Jerseyans. Together, he estimates that the initiatives will direct an additional $1.3 billion to the state each year. Senate leaders have pledged to work with him on both proposals.

He may face a difficult road, however. On marijuana legalization, he’ll have to overcome the objections of some lawmakers in his own party before making New Jersey just the eighth state to allow recreational use of cannabis. Assuming a bill passes, the state will have to set up a complex regulatory apparatus to reap the financial benefits of the drug market, which could take years. Even then, some states have seen lower-than-expected revenues after permitting medical weed.

Matters get even more complicated when it comes to new levies. Democrats have yearned for a “millionaires’ tax” since the end of Corzine’s tenure and actually passed five separate bills establishing one (Christie vetoed each attempt). Under normal circumstances, they would likely provide one for Murphy’s signature within weeks.

The Republican tax cut passed in Washington casts significant doubt on that prospect. The new limitations on the deduction for state and local taxes will impose unique burdens on New Jersey residents, who pay an average real estate bill of over $8,500 annually. In that kind of environment, any new tax will be viewed with a great deal of skepticism. If the state’s wealthiest taxpayers flee across state lines, it would put the state’s future in even greater financial jeopardy.

At the same time the tax bill was moving toward passage, the lame duck governor added a new wrinkle: In a move seen by some as a final shot on his way out of Trenton, Christie lowered the expected rate of return on the pension fund’s investments from 7.65 percent to 7 percent. While that sounds like a minor accounting move, the revision raised the pension bill by $800 million next year.

The fiscal threat over the next decade is now so great that Murphy and his Democratic allies will likely be forced to take some corrective steps. If current trends persist, ratings agencies have warned that the state’s pension system could go completely broke within a decade, possibly dragging down the state economy with it.

“In the end, I think they have to [reach a deal with NJEA],” said Waters. “This is people’s lives. This is people’s retirement. There have got to be some concessions made.”

Help fund stories like this. Donate now!

;)