Analysis: Did School System Retirements Spike in 2020? Data from 7 State Pension Plans Show They’ve Actually Decreased

Back in May, USA Today reported the findings of an alarming poll. At the time, the paper wrote, “1 in 5 teachers say they are unlikely to go back to school if their classrooms reopen in the fall, a potential massive wave of resignations.”

So did this massive wave of teacher resignations actually happen?

Not that we can tell. Although USA Today deserves some responsibility for blowing up the fear over teacher retirements in the spring, it also deserves some credit for following up this fall with an update under the headline, “Fear of mass teacher retirements due to COVID-19 may have been overblown.” While not a comprehensive look at every state, the reporters found that teacher retirements were down 31 percent in Tennessee and 5 percent in Indiana, versus a 4 percent increase in New York.

After the original story, we started our own effort to collect retirement data for 2020 by reaching out to teacher pension plans for every state. While the plans typically include other types of education employees beyond teachers, it’s the best available data source short of going district by district. Based on the data available thus far, retirements from teacher pension plans have not gone up in 2020. If anything, there are fewer in 2020 than in years past.

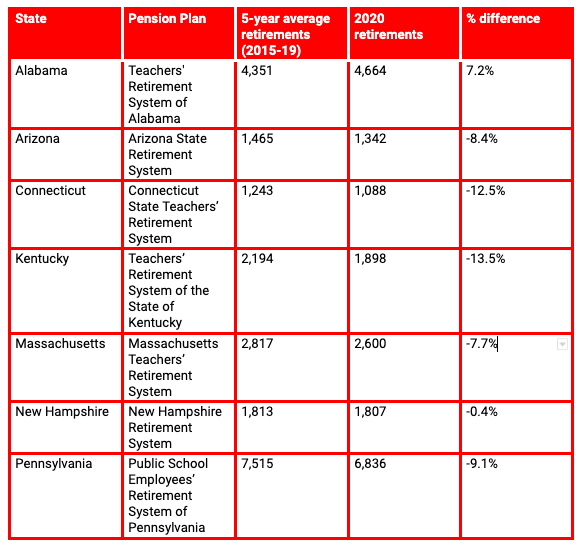

After attempting to canvass all 50 states and Washington, D.C., we were able to get retirement data for Alabama, Arizona, Connecticut, Kentucky, Massachusetts, New Hampshire and Pennsylvania. While this is not a random sample, it does capture about 865,000 active workers, including teachers and other education employees. Only one of the states in our sample, Alabama, reported a larger number of retirements this year than in recent years, and that by 7 percent.

Collectively across our sample, we found retirements were down in 2020 by about 5 percent.

The Arizona State Retirement System provided the most detailed response to our query. In an email exchange that included the data, they concluded, “ASRS has not seen a notable increase in teacher retirements in 2020 compared to previous years. Likewise, we have looked at participation in our pre-retirement webinars, online meetings and other pre-retirement educational programs provided by the ASRS and have seen no noticeable increase this year over previous years.”

We do not have sufficient data to explain exactly why retirements are down this year, but there are structural reasons that keep teacher retirement patterns relatively steady. About 90 percent of public school teachers are enrolled in defined-benefit pension plans, where retirement benefits are guaranteed based on the worker’s years of experience and age. Those plans offer predictable, guaranteed benefit payments regardless of external economic factors. In addition, about two-thirds of public school teachers serve in states or districts that provide health care benefits to eligible retirees.

The combination of guaranteed retirement benefits and health insurance means that public school educators are in a more stable position financially than other Americans who are nearing retirement age. In contrast to teachers, most Americans depend on their own personal savings to fund their retirement, and they must continue working in order to receive health care benefits from their employer, at least until they turn 65 and qualify for Medicare. While educators or their partners may face other economic hardships, they can at least count on the security of their pension and health care benefits.

Research has found that these structural factors make a difference. Veteran teachers are aware of their pension benefits and time their retirements accordingly. Retiree health care benefits also give teachers confidence to retire at younger ages than they otherwise would. These factors help keep teacher retirements relatively stable year to year. Even during economic recessions, teacher retirement patterns continue mostly as normal.

During the current pandemic, the case for a massive surge of retirements was built on the not-unreasonable belief that older teachers would be unwilling to face the health risks of delivering in-person instruction. But with the majority of teachers assigned to, pushing for or opting into remote environments this fall, K-12 educators have not been exposed to as much COVID-19 risk as initially feared. In the early stages of the pandemic, it was widely perceived that schools could serve as potential superspreader environments.

That fear helped shut down most of the nation’s K-12 schools and drove students and teachers to virtual education. While few educators — and families — are pleased with the current schooling arrangements, virtual schooling at least limited exposure to potential COVID-19 risks. A growing body of research suggests that transmission risks in K-12 schools are not as high as initially feared, but starting the year in the relative safety of virtual settings may have prompted near-retirement teachers to remain in their Zoom classrooms.

While the story is not over yet, the available evidence suggests that teacher retirements are proceeding as normal, even during the depths of an economic recession and a raging pandemic.

Chad Aldeman is a senior associate partner at Bellwether Education Partners and the editor of TeacherPensions.org.

Alex Spurrier is a senior analyst with Bellwether Education Partners in the policy and evaluation practice area.

Get stories like these delivered straight to your inbox. Sign up for The 74 Newsletter

;)